Budget’s black money legalization scheme is likely to do more harm than good

Abu Jakir

Publish: 08 Jun 2024, 03:48 PM

The budgetary proposal to allow financial criminals to legitimize their black money with a mere 15% tax and complete pardon has sparked widespread concern among economists, civil society, and the general public.

Critics argue that this low rate unfairly penalizes honest taxpayers who are subject to a much higher tax burden of up to 30%.

Speaking about the provision for legalizing black money during a post-budget briefing on Friday, Dr. Fahmida Khatun, Executive Director of the CPD, remarked that the 15% tax rate without any investigation dissuades regular taxpayers.

"Over the past few years, we've observed that offering this option doesn't significantly boost revenue collection. Instead, it provides incentives for those with black money while demotivating consistent taxpayers," she said.

CPD distinguished fellow Mustafizur Rahman criticized the disparity in tax rates between legal and illegal income, stating that it's unjust for law-abiding taxpayers to face higher rates than those who have evaded taxes.

He advocated for stricter laws and penalties for illegal earnings, including additional taxes on top of the proposed 15% legalization rate.

Mustafizur also raised concerns about a provision in the budget proposal that shields the source of legalized income from investigation.

He illustrated this by saying, "Imagine someone legalizes their money by paying taxes, but the Anti-Corruption Commission later investigates the origin of those funds. The current budget proposal would prevent such an inquiry."

Dr Mustafizur contrasted the new policy with the existing Income Tax Act 2023, which has a controversial provision that allows the legalization of undisclosed income through a reduced tax rate of 15%, without any investigation into its origin.

This is a significant departure from previous policies, which typically required higher tax rates and penalties for such declarations, he said.

Does injecting black money boost the economy?

Prime Minister Sheikh Hasina however endorsed the budget's provision for legalizing black money, emphasizing the importance of integrating it into the formal financial system initially.

"The funds should initially be routed through the appropriate channels, such as the banking system, with the payment of a nominal tax. Subsequently, regular taxes should be paid... Just as you need to provide feed when catching fish," she told a public forum on Friday.

Abu Hena Md Rahmatul Muneem, the chairman of the National Board of Revenue also defended the provision to legalize undeclared assets, stating that it aims to help those who didn't report their wealth due to lack of knowledge or complex regulations.

Muneem also mentioned that individuals with illegal assets usually avoid investing them in the country's economy.” So, repatriating black money could boost the economy,” he pointed out.

Muneem clarified that while such amnesties are often seen as a way to legitimize illicit funds, the one chalked out in the budget focuses on addressing undeclared assets that exist due to various reasons.

He also emphasized that many countries offer similar opportunities to report previously undisclosed assets due to unavoidable circumstances. This measure, he stated, was implemented in response to requests from businesses and individuals, aiming to promote compliance and prevent money laundering.

Experts concerned however said that granting amnesty to tax evaders incentivizes illicit financial activities and undermines honest taxpayers.

This is because the underlying math is simple: converting legitimate income into black money and then legalizing it results in a 50% tax savings, th no penalty or accountability, said Dr Mustafizur of CPD.

The problem with shadow economy

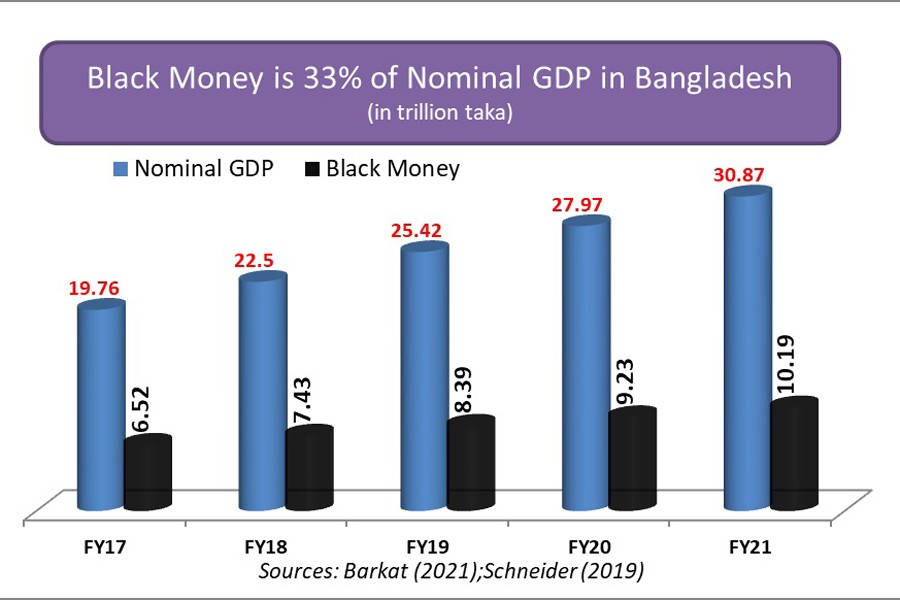

Reports from the IMF and the finance ministry, though varying in figures, both highlight the massive scale of Bangladesh's shadow economy.

As per a report by the IMF in 2015, the scale of our informal economy was approximately Tk 4,532.71 billion. Meanwhile, a finance ministry report from 2012, focusing on the clandestine economy, approximated that black money constituted between 45-85 percent of Bangladesh's GDP

This hidden economy not only harbors vast sums of untaxed money, often linked to crime and corruption, but also perpetuates a vicious cycle where illicit funds fuel further illegal activities.

Experts concerned pointed out that the consequences are dire, imposing significant social costs on communities, even if these effects are hard to quantify financially.

The World Bank's analysis of Bangladesh's lower-than-expected revenue collection highlighted several issues, including low compliance and lack of trust in tax authorities.

They noted that "honest taxpayers become frustrated when they face extra scrutiny while tax evaders go unchecked." Additionally, the World Bank pointed out that "taxpayers are demoralized by repeated opportunities to legalize undeclared money."

Supporters of an unconditional scheme to legalize black money point to the success of the FY2020-21 program, where a record Tk 20.6 billion was legalized, generating Tk 2.04 billion in tax revenue for NBR.

This program saw participation from over 12,000 individuals across various professions. However, the subsequent decline in participation after the scheme ended highlights the potential limitations of such one-time initiatives.

Now the new budgetary provisions of legalizing huge amounts of black money with a mere 15% tax would be a band-aid solution rather than a sustainable one, argued critics.

Transparency International Bangladesh (TIB) voiced concerns in a statement released on June 6, arguing that the 15% tax rate with no investigation encourages tax evasion and disincentivizes honest taxpayers.

TIB stated that "This provision creates a breeding ground for corruption and goes against the ruling party's pledge of zero tolerance for corruption." They called on the government to revoke this policy, deeming it a form of money laundering.