How accounting anomalies wipe $10 Billion off Bangladesh's export ledger

-6686fb6d35eb3.png)

In a dramatic turn of events, the National Board of Revenue (NBR) has finally corrected its export data this week, shattering the illusion of a thriving export sector.

The revised figures reveal a staggering $10 billion overestimation over the past nine months, turning the previously celebrated positive growth into a stark negative reality.

This revelation comes as a major blow to the nation's economic outlook, as the export sector is a crucial pillar of growth.

The discrepancy, which was previously attributed to delayed export receipts, has now been exposed as an error in the data itself, confirming the doubts long harbored by exporters who questioned the rosy official figures.

The billion dollar discrepancy between export shipments and actual receipts in Bangladesh, although not unprecedented, has raised concerns about potential capital flight.

The whole discrepancy in export data stemmed from the mismatch between the Bangladesh Bank's (BB) reported realization and the Export Promotion Bureau's (EPB) shipment figures from FY23.

For that financial year, the export figure contrasts sharply with the EPB's reported $63.05 billion in goods and services exports for FY23, compared to the central bank's figure of $50.97 billion.

While a gap between the EPB and BB figures is typical, usually hovering around $4-5 billion, it had been steadily rising, reaching $8.51 billion in 2021-22 and then reached a staggering height of more than $12 billion for FY23.

Adjustment of accounting anomalies

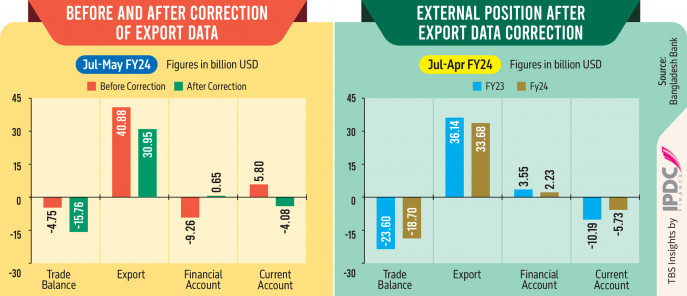

The Bangladesh Bank's adjustment of inflated export figures by $10 billion for July-March of FY24 has led to a surprising reversal in the financial account balance.

This correction reveals that previously blamed exporters for non-repatriation of export proceeds were not the primary cause of the financial account deficit.

The revised data paints a starkly different picture: export earnings, initially showing 5.53% year-on-year growth, have plummeted to a negative 6.8%.

This drastic change has also flipped the current account balance from a $5.7 billion surplus to a $5.7 billion deficit in July-April.

Specifically, total exports for July-March, originally recorded at $40.8 billion, have been drastically reduced to $30.9 billion after the NBR's correction.

Further, July-April exports now stand at $33.6 billion, a significant $2.4 billion less than the previous year's figure.

This data revision exposes the overestimation of export figures and its far-reaching consequences, shifting the narrative surrounding the financial account balance and overall economic performance.

The NBR's data corrections have also led to a widening of the trade deficit from $4.7 billion in July-March to $18.6 billion in July-April. This revision further reveals a $15.7 billion current account deficit in July-March.

Economists express shocks

Central bank officials have clarified that the EPB publishes figures based on customs department data, which, due to procedural reasons, sometimes includes double or triple counting of the same export data, leading to inflated figures.

This revelation however sheds light on the significant discrepancies between the two agencies' data and raises questions about data accuracy and reporting procedures.

The magnitude of the error in such crucial data has shocked economists, including Dr. Ahsan H Mansur of the Policy Research Institute. He warns of significant consequences on key economic indicators, such as the export-to-GDP ratio and debt servicing calculations.

The reduced export figures will not only lower the export-to-GDP ratio but also increase the burden of debt servicing. The data correction has shattered the illusion of good export performance, revealing a harsh reality.

Dr. Mansur calls for a government inquiry into the incorrect export entries to determine if any individuals or groups benefited, particularly as exporters receive incentives based on export earnings.

The International Monetary Fund (IMF) earlier expressed concerns about the substantial negative trade credit contributing to the financial account deficit in FY24.

In its second review report on the $4.7 billion loan package, the IMF highlighted significant delays in the repatriation of export proceeds as a major factor behind the large negative trade credit and subsequent financial account deficit.

Meanwhile, the recent correction of a nearly $12 billion overestimation in export figures by the BB and the EPB has led to a positive shift in the financial account after more than a year.

However, this seemingly positive news does not reflect an actual improvement in the country's economic health.

“While this correction has resulted in a positive financial account, it does not change the underlying reality that Bangladesh continues to grapple with a shortage of foreign currency, said former lead economist of the World Bank Dr Zahid Hussain.

This situation underscores the importance of accurate data reporting and highlights the challenges Bangladesh faces in maintaining a stable and healthy economy, he added.

—