Bashundhara family's alleged money laundering fuels nearly 1000 crore taka (£62 million)UK property spree

When Sayem Sobhan Anvir, Managing Director of Bashundhara Group, was implicated in the rape and murder case of college student Mosarrat Jahan Munia in April 2021, it quickly became a hot topic on Bangladeshi social media.

One meme that circulated widely suggested, "If anything happens to Anvir, people will lose faith in the power of money."

However, the influence of money prevailed, as the Police Bureau of Investigation (PBI) submitted a probe report a year and a half later that sought Anvir's exoneration, claiming they found no connection between him and Munia’s murder.

Bashundhara Group is among Bangladesh's largest business conglomerates, having entered the prestigious billion-dollar club in September last year, joining other major players like Square Group and Pran Group.

While its diverse portfolio spans from gold to bitumen production, Bashundhara's primary strength lies in real estate, a sector founded by Ahmed Akbar Sobhan in the late 1980s.

In just three decades, properties in Bashundhara-branded areas have become some of the most sought-after and expensive in Dhaka.

Despite numerous allegations of land grabbing and river encroachment against the group, similar to Anvir’s case, Bashundhara has consistently avoided legal repercussions.

Following Sheikh Hasina's fall due to a mass uprising, the Criminal Investigation Department (CID) launched a comprehensive investigation into Bashundhara’s alleged land grabbing and unlawful filling of public properties, including canals, wetlands, and cemeteries.

This CID inquiry also includes money laundering allegations against Bashundhara Group's Chairman Ahmed Akbar Sobhan and Managing Director Anvir, according to multiple sources within the CID who spoke to Bangla Outlook.

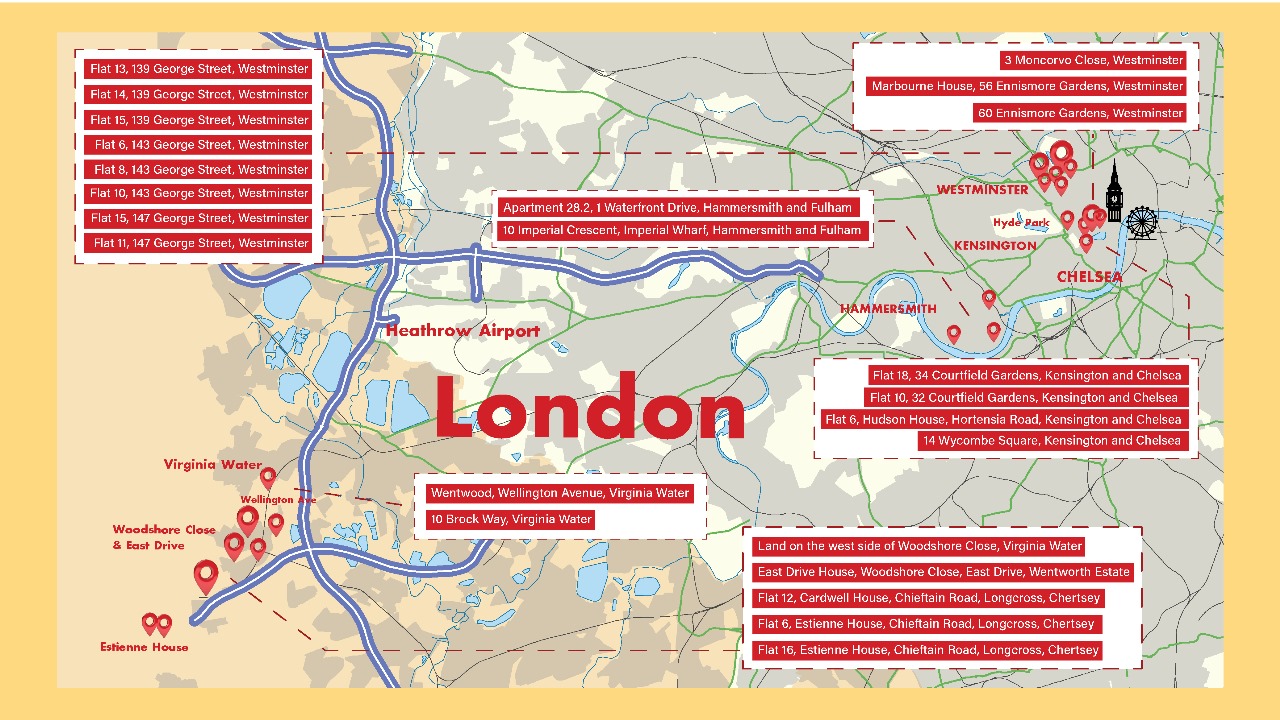

While no evidence of money laundering by Sobhan or Anvir has been made public, an investigation by Bangla Outlook uncovered a list of 26 properties valued at nearly 1000 crore taka (60 million pound sterling) in the United Kingdom.

This raises questions for investigators regarding potential money laundering, especially since there’s no record of such significant funds being transferred with central bank approval, and Bashundhara Group has no business interests outside Bangladesh.

Luxurious UK properties

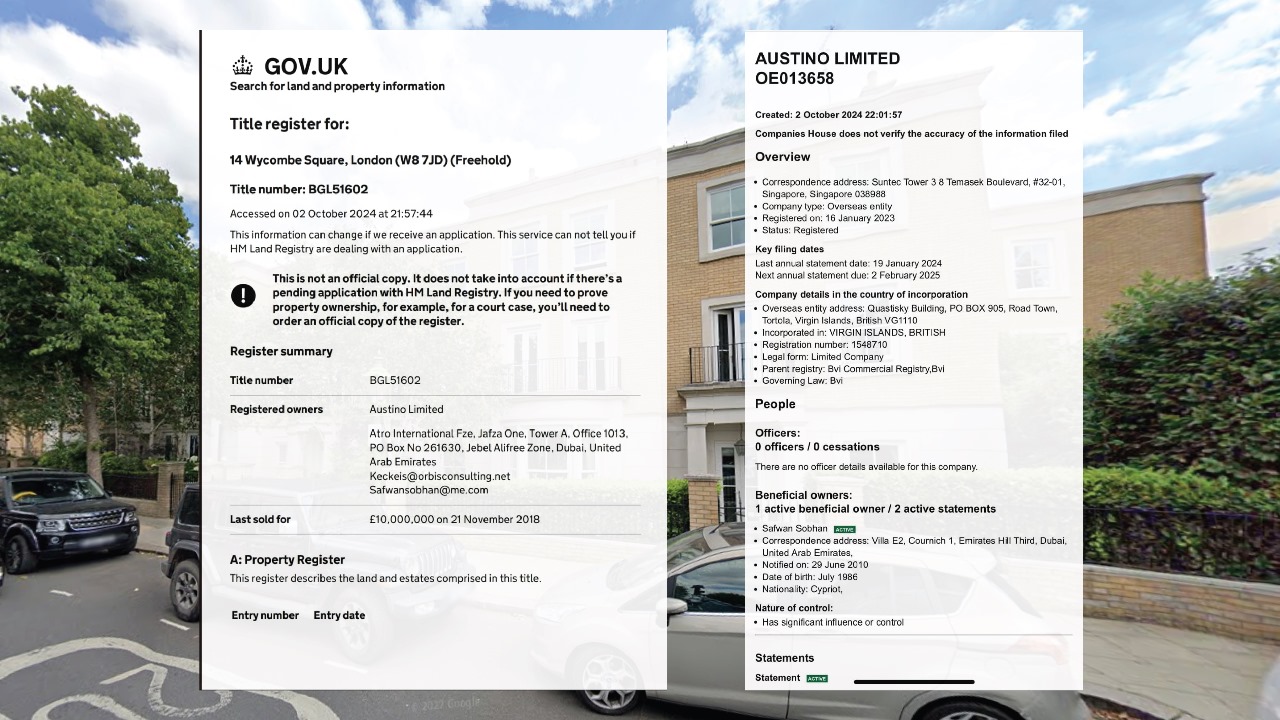

The crown jewel of the Bashundhara scions' real estate portfolio is 14 Wycombe Square in central London, valued at approximately 158 crore taka (10 million pounds).

This freehold property–any estate which is free from the hold of any entity besides the owner– spans nearly 5,000 square feet and is owned outright, free from any encumbrances.

Acquired on November 21, 2018, through a company named Austino Limited—likely a shell company registered in the British Virgin Islands with an office in Dubai—the property is owned by Safwan Sobhan, the vice chairman of Bashundhara Group and the younger brother of Anvir.

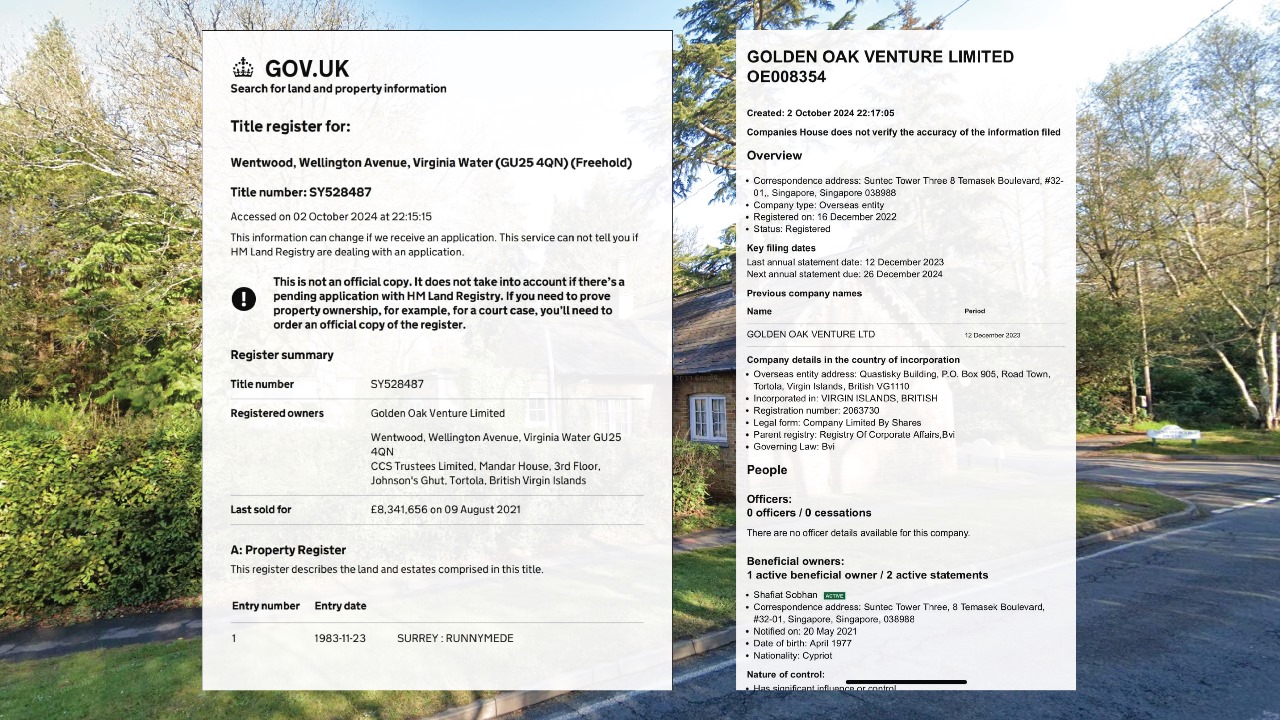

The second most valuable property held by Bashundhara's scions is Wentwood on Wellington Avenue, Virginia Water, Surrey, UK. This freehold property was bought on August 9, 2021, for about 130 crore taka (8.34 million pounds).

This property was acquired through Golden Oak Venture Limited, another shell company registered in the British Virgin Islands, with a corresponding office at Suntec Tower in Singapore.

The registered owner is Shafiat Sobhan, another vice chairman of Bashundhara Group and son of Ahmed Akbar Sobhan.

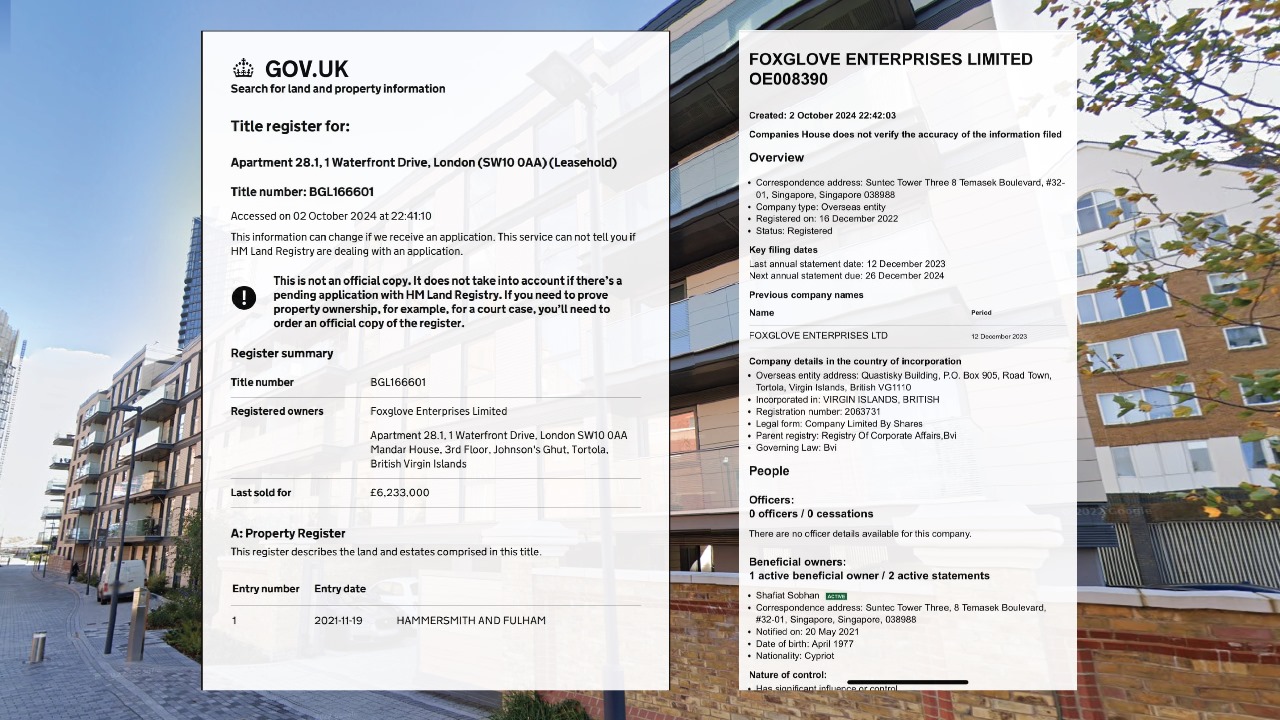

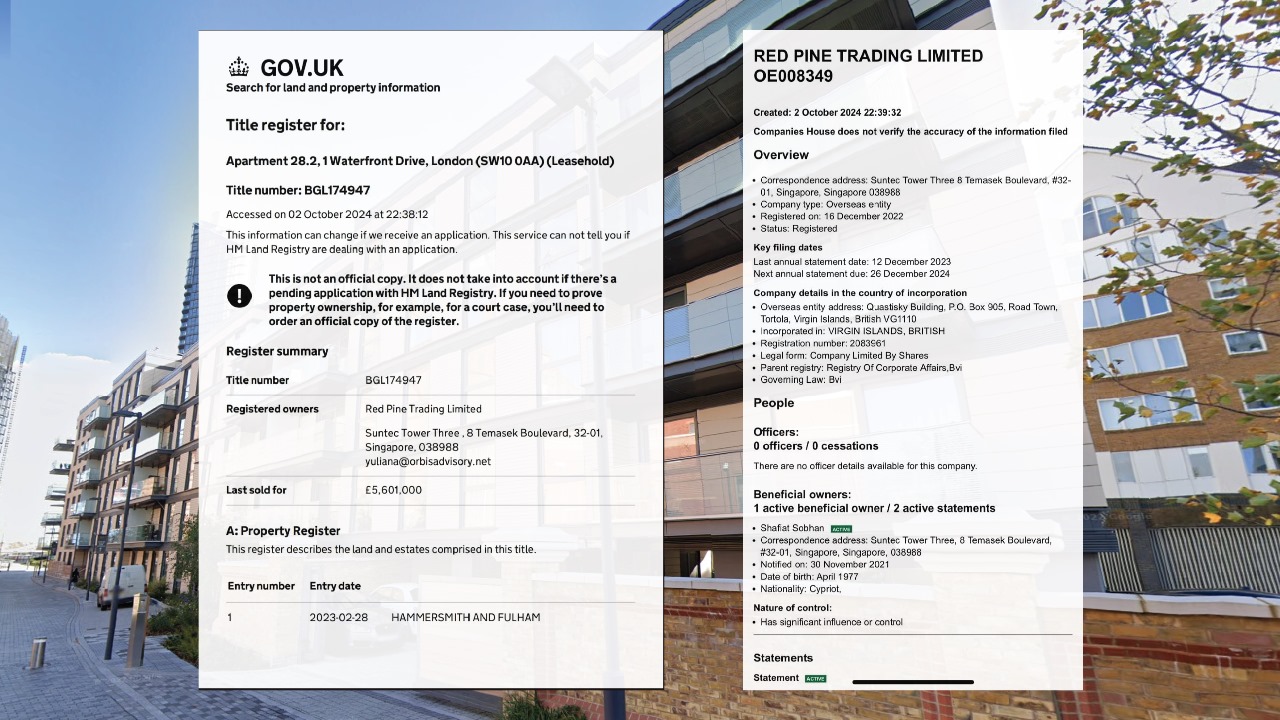

The third most expensive holdings are two apartments on the 28th floor of 1 Waterfront Drive, a luxury building in central London. One apartment was purchased for nearly 105 crore taka (6.23 million pounds), while the other cost around 92 crore taka (5.61 million pounds).

Both apartments were bought through Foxglove Enterprises Ltd and Red Pine Trading Limited, registered in the British Virgin Islands with offices at Suntec Tower, Singapore. Shafiat Sobhan is the owner of both companies.

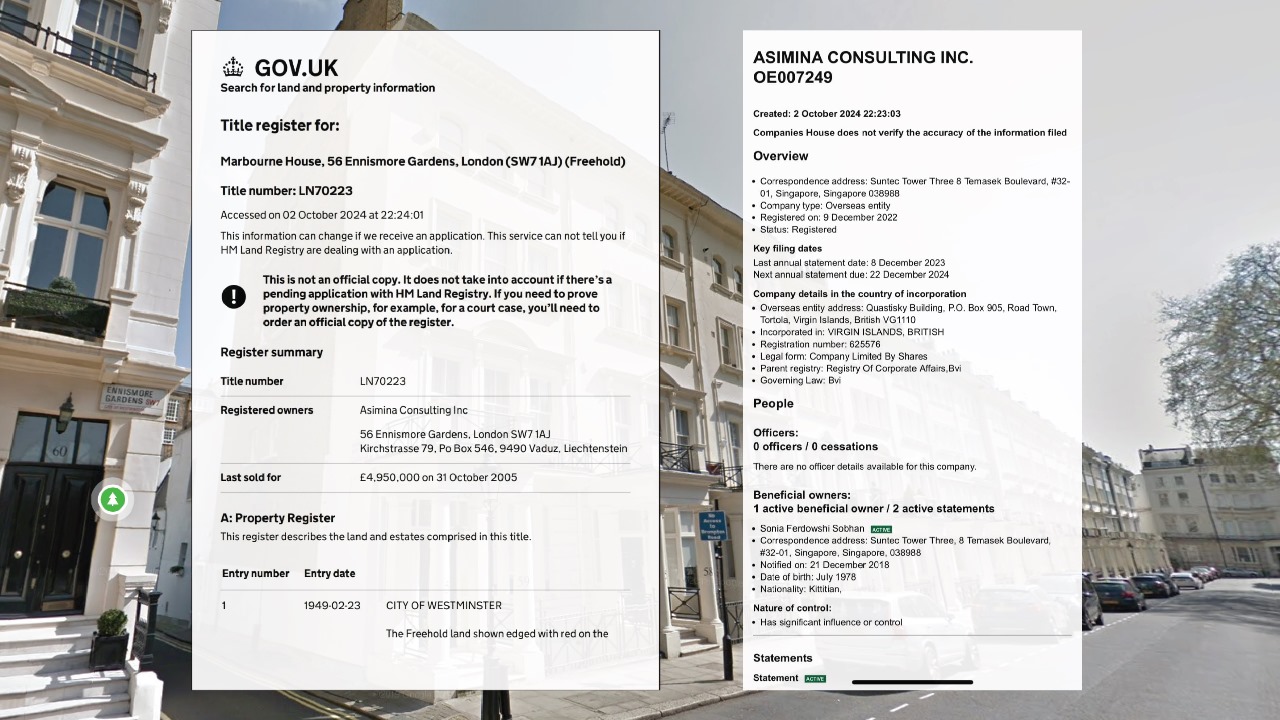

Next in line is Marbourne House, located at 56 Ennismore Gardens, London, another freehold property. This property was purchased on October 31, 2005, for about 78 crore taka (4.95 million pounds).

The registered owner of this property is Asimina Consulting Inc, also a British Virgin Islands company with an office in Suntec Tower, Singapore, owned by Sonia Ferdoushi Sobhan, wife of Sadat Sobhan Tanvir, the eldest son of Ahmed Akbar Sobhan.

Bangla Outlook discovered that over the past 15 years, 21 additional residential properties ranging from 8 crore to 50 crore taka have been acquired by various family members of the Bashundhara Group.

Why do these purchases indicate money laundering?

However, during this time, neither Bashundhara Group nor any of its family members have been reported to have filed for transferring significant amounts of money out of Bangladesh through legal channels, as confirmed by sources at Bangladesh Bank to Bangla Outlook.

A report from The Daily Star in early September cited an unnamed CID official who claimed that Bashundhara Group has borrowed over Tk 42,000 crore from various scheduled banks in the country by inflating the value of land purchases, presenting them as worth Tk 3 crore per katha instead of the actual Tk 20-25 lakh per bigha.

The CID official also alleged that a significant portion of these funds has been laundered to Dubai, Singapore, Cyprus, London, Malaysia, and other countries.

Notably, Ahmed Akbar Sobhan's eldest son, Sadat Sobhan, manages the Bashundhara Group office in Singapore.

Meanwhile, property purchase records indicate that all members of the Bashundhara Group have listed other nationalities—Safwan Sobhan and Shafiat Sobhan have identified as Cypriots, while Sonia Sobhan has claimed nationality from Saint Kitts.

To obtain citizenship in Cyprus through investment, a minimum of two million euros must be invested in the country.

While Bangla Outlook could not verify the exact amounts spent by Safwan, Shafiat, or Sonia to acquire their foreign nationalities and passports, it did uncover that Sayem Sobhan Anvir and Director Yasha Sobhan invested 3 million and 2 million euros, respectively, to purchase passports for Slovakia and Cyprus.

The investigation found out that Anvir serves as a director of a Slovakian company named Wordera Corporation (ICO Number: 47955414), which was established on November 5, 2014. Sayem Sobhan Anvir and Sabrina Sobhan are partners in the company, which has a capital of 1 million euros.

Bangladesh Bank has confirmed that it does not permit any transactions for investments in foreign citizenship. There are no legitimate means to invest abroad without the bank's approval, leading to the conclusion that this situation may be classified as money laundering.

In July 2020, an Al Jazeera investigation revealed that four individuals, including the former president of Cyprus, were implicated in corruption related to the citizenship by investment program.

The report outlined how these individuals enabled the unlawful granting of citizenship to criminals from China and Russia, but it did not mention any Bangladeshi individuals.

Bangla Outlook attempted to reach several members of the Bashundhara family, including Ahmed Akbar Sobhan and Sayem Sobhan Anvir, but was unable to make contact or obtain their responses despite numerous attempts.

Global anti-graft body probes into Bashundhara

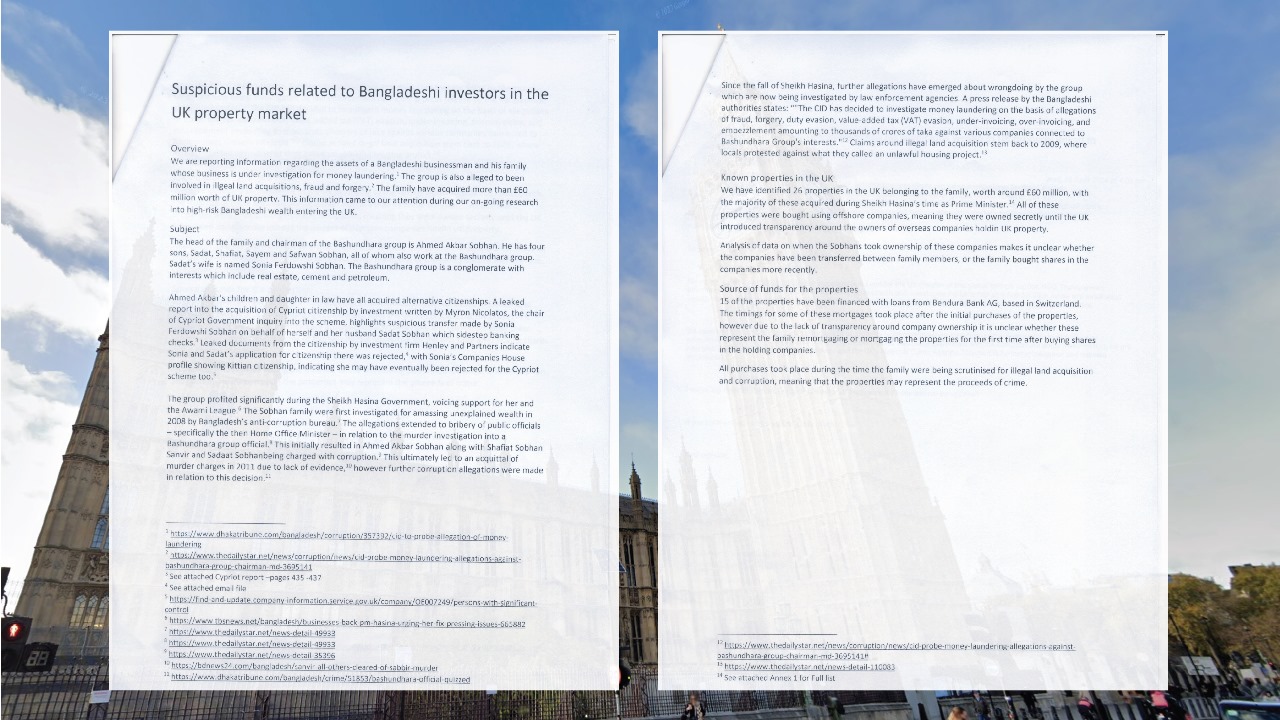

An internal memo titled “Suspicious funds related to Bangladeshi investors in the UK property market” of the Transparency International of the UK chapter indicate that they are probing Bashundhara's UK real estate and the portfolio’s source of funds.

The memo said they have identified 26 properties in the UK belonging to the Bashindhara family, worth around £60 million, with the majority of these acquired during Sheikh Hasina's time as Prime Minister.

“All of these properties were bought using offshore companies, meaning they were owned secretly until the UK introduced transparency around the owners of overseas companies holding UK property,” said the memo.

The anti-graft body’s memo further stated that 15 of the properties have been financed with loans from Bendura Bank AG, based in Switzerland.

“The timings for some of these mortgages took place after the initial purchases of the properties, however due to the lack of transparency around company ownership it is unclear whether these represent the family remortgaging or mortgaging the properties for the first time after buying shares in the holding companies,” said the memo.

“All purchases took place during the time the family were being scrutinized for illegal land acquisition and corruption, meaning that the properties may represent the proceeds of crime,” the memo added.

The memo also pointed out that Ahmed Akbar's children and daughter in law have all acquired alternative citizenship.

The memo stated that a leaked report on the acquisition of Cypriot citizenship by investment, authored by Myron Nicolatos, the chair of the Cypriot government inquiry into the scheme, highlights a suspicious transfer made by Sonia Ferdowshi Sobhan on behalf of herself and her husband, Sadat Sobhan, which bypassed banking checks.

Leaked documents from the citizenship by investment firm Henley and Partners reveal that Sonia and Sadat's application for citizenship was rejected. Additionally, Sonia's Companies House profile indicates Kittian citizenship, suggesting she may have also been rejected from the Cypriot scheme.

The ant-graft body’s memo also reported that the Bashundhara group profited significantly during the Sheikh Hasina Government, voicing support for her and the Awami League.

“The Sobhan family were first investigated for amassing unexplained wealth in 2008 by Bangladesh's anti-corruption bureau. The allegations extended to bribery of public officials - specifically the then Home Office Minister - in relation to the murder investigation into a Bashundhara group official.”

This initially led to Ahmed Akbar Sobhan, along with Shafiat Sobhan Sanvir and Sadaat Sobhan, being charged with corruption. Ultimately, in 2011, they were acquitted of murder charges due to insufficient evidence. However, the memo noted that additional corruption allegations arose concerning this decision.

—--