Taming inflation in Bangladesh: The need for macroeconomic and structural reforms

Bangladesh faces a pressing economic challenge: a persistent rise in prices impacting the daily lives of its citizens. To understand this complex situation, it's crucial to distinguish between isolated price increases and the broader phenomenon of inflation.

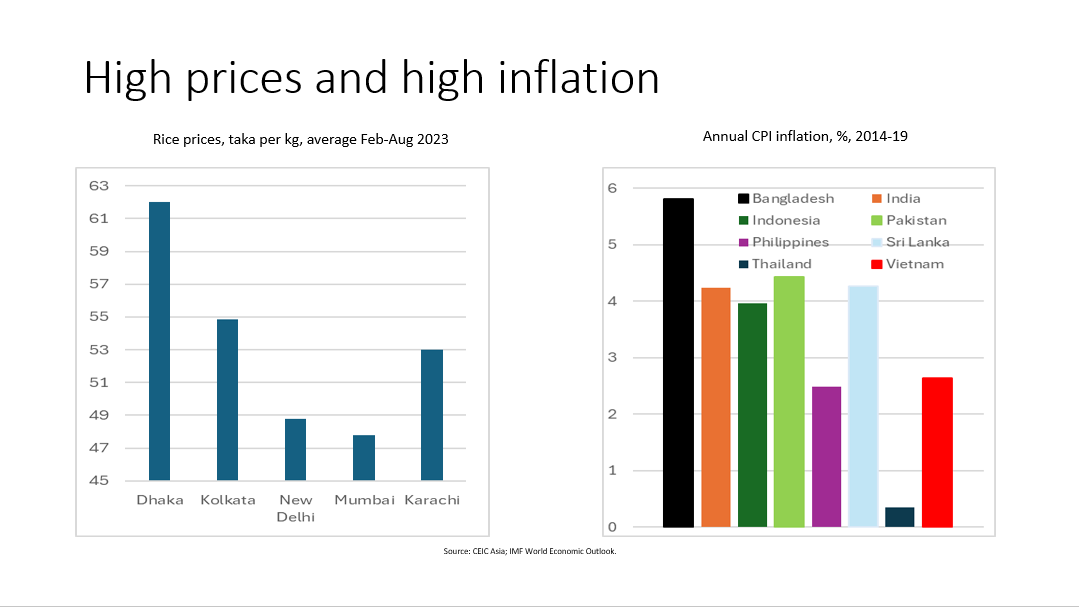

While high prices for specific goods, like the recent surge in rice prices observed in Dhaka compared to other subcontinental megacities during the summer of 2023, are driven by microeconomic factors such as supply chain disruptions or export demand, high inflation is a different beast altogether.

Inflation reflects macroeconomic imbalances, particularly in monetary and fiscal policies. Expansionary monetary policy, characterized by low interest rates or a rapid increase in the money supply, can fuel inflationary pressures.

Similarly, large government deficits financed by excessive borrowing contribute to a surge in overall prices.

These macroeconomic policies are often intertwined with the underlying political economy and growth model of a nation.

In Bangladesh, factors such as structural weaknesses in the economy, subsidy programs, or governance challenges can exacerbate inflationary trends.

So, taming inflation in Bangladesh necessitates a multi-pronged approach. In the near term (over the next six to nine months), tighter macroeconomic policies are essential.

This could involve raising interest rates to curb demand, controlling government spending, and implementing measures to stabilize the exchange rate, potentially bringing inflation down to 6-7%.

However, achieving sustained price stability requires a long-term recalibration of the political economy. This includes critical reforms such as improving governance and institutional capacity, diversifying the economy away from reliance on a few sectors, and promoting greater competition in markets.

Ultimately, addressing inflation in Bangladesh requires not just short-term fixes but a commitment to deep, structural reforms that address the root causes of macroeconomic instability.

The long and persisting inflation

Even before the pandemic and global economic upheavals of recent years, Bangladesh faced a persistent challenge with inflation.

Between 2014 and 2019, a period marked by low global oil and food prices, a booming global economy, and relative stability of the Bangladeshi Taka, the country experienced an average annual inflation rate close to 6%. This was notably higher than the 2-4% rate observed in neighboring countries.

This persistently high inflation can be attributed to the underlying growth model pursued by the Hasina regime. While the Bangladeshi economy has traditionally relied on RMG exports and remittances since the 1980s, the government's focus on megaprojects and the proliferation of poorly managed banks introduced new dynamics.

This led to loose macroeconomic policies, with demand outstripping supply and fueling inflationary pressures.

While external shocks like the Ukraine War and

rising interest rates in advanced economies undoubtedly contributed to the

recent surge in inflation and the depreciation of the Taka, Bangladesh's

vulnerability to these shocks is rooted in these pre-existing structural

weaknesses.

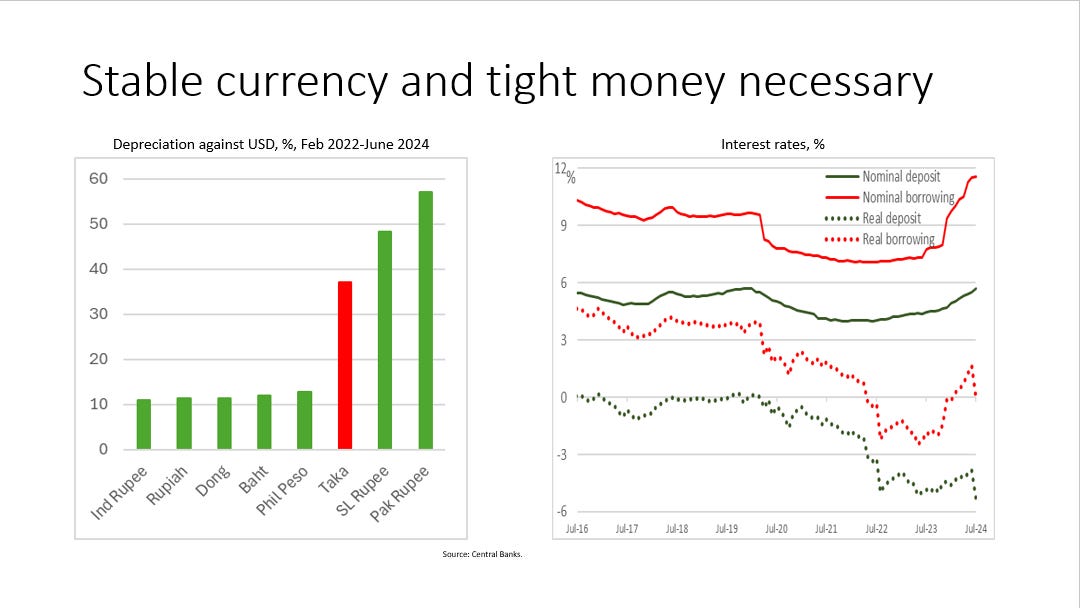

The depreciation of the Taka, in particular, was more pronounced compared to other relatively stable economies in Monsoon Asia, highlighting this underlying fragility.

Looking ahead, stabilizing the exchange rate and implementing higher real interest rates could help curb inflation, potentially reducing it from the current 9-10% to 6-7% by mid-2025.

However, these are merely short-term measures. To truly address the persistent inflationary pressures, Bangladesh needs to revisit its growth model and macroeconomic policy framework.

This requires a shift towards more sustainable and inclusive growth strategies that prioritize productive investments, strengthen financial institutions, and promote greater economic diversification.

The policy missteps

The policy missteps

The recent economic turmoil in Bangladesh, characterized by soaring inflation and a depreciating Taka, is largely a consequence of policy missteps by the previous administration.

Faced with external shocks like the Ukraine War and rising global interest rates, the standard response to maintain currency stability is to raise domestic interest rates.

However, the previous regime opted for interest rate caps, resulting in negative real borrowing rates for an extended period. This decision lacked any sound policy rationale and instead reflected a political economy driven by short-term gains. Essentially, it made money cheaper than free for those with access, who then took advantage and moved significant sums abroad, particularly in the lead-up to the January 2024 election.

This capital flight created immense pressure on the Taka, evident in the flourishing informal "hundi" market.

With formal remittances remaining weak, foreign currency reserves dwindled, further accelerating the Taka's depreciation and fueling inflation. The regime's response, import controls, only exacerbated the situation by creating supply chain disruptions and further driving up prices.

The current government, in contrast, is taking steps to reverse these damaging dynamics. The Bangladesh Bank is pursuing a policy of raising real interest rates and allowing market forces to determine borrowing and lending rates, signaling a shift towards a modern monetary policy framework.

These measures, coupled with the relative stability of the Taka since the Monsoon Uprising and a surge in remittances since August, point towards an expectation of currency stability in the near future.

If this positive trend continues, and in the absence of further external shocks, inflation is projected to gradually decline to 6-7% in the coming months, aligning with Governor Ahsan H Mansur’s expectations of achieving this target by June 2025.

However, it's important to remember that sustained economic stability requires continued commitment to prudent macroeconomic management and structural reforms that address the underlying vulnerabilities of the Bangladeshi economy.

Growth model for the future

Undoubtedly, there's a trade-off between taming inflation and maintaining economic growth.

Higher interest rates, while effective in curbing inflation, can also dampen economic activity. However, Bangladesh's robust remittance inflows and a potential recovery in exports could provide a buffer, mitigating the adverse effects of rising interest rates to some extent.

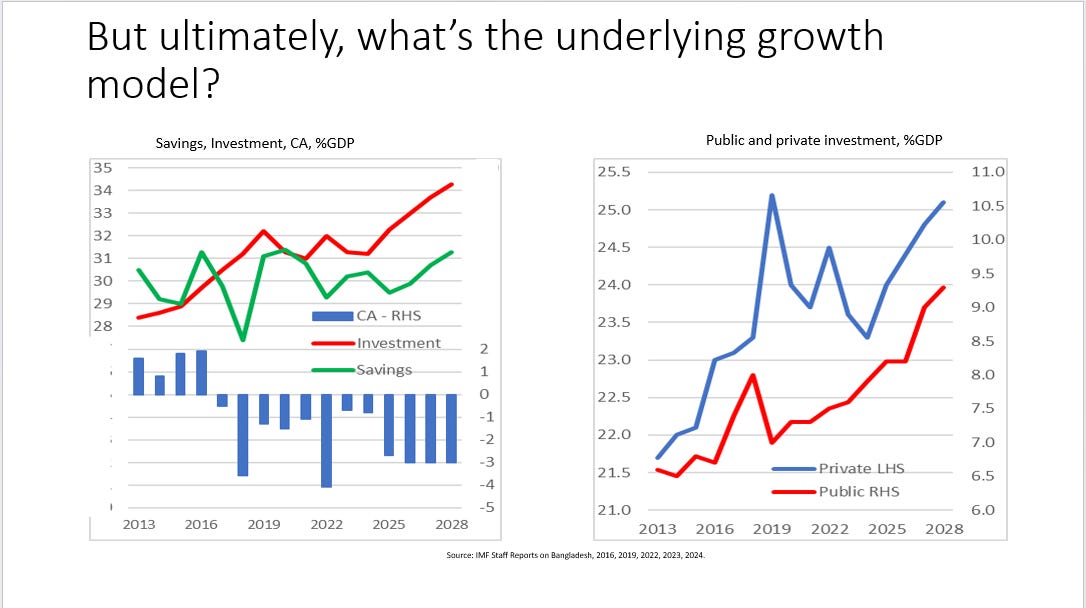

While Governor Ahsan aims to reduce inflation further, achieving a lower target of 4-5% in the long run would require a fundamental shift from the old growth model characterized by twin deficits (fiscal and current account) and heavy reliance on externally financed public investments.

Even with full implementation of the previous

IMF program, projections indicated a significant current account deficit

persisting into the late 2020s, leaving the Taka vulnerable to depreciation

pressures and the risk of reigniting inflation.

It's important to emphasize that public investment isn't inherently detrimental. Well-planned, productive investments can expand the economy's capacity and boost growth without necessarily fueling inflation.

However, this wasn't the case under the previous regime, where many projects suffered from poor planning and execution.

This raises a crucial question for Bangladesh: what kind of growth model do we want for the future?

Achieving sustainable economic development with low inflation requires a national conversation on reorienting the growth strategy. This could involve prioritizing investments in human capital, promoting export diversification, strengthening domestic resource mobilization, and improving governance to ensure efficient allocation of resources.

Ultimately, a more inclusive and sustainable growth model is essential for achieving long-term price stability and improving the living standards of all Bangladeshis.

—-

J Rahman is an economist and a writer. The article first appeared in his newsletter ‘Mukti’. It is republished here with stylistic edits and the author’s permission.