Rupali Bank ex-MD accused of irregular loan approval amidst financial misconduct allegations

Abdur Rahman

Publish: 11 Oct 2024, 06:48 PM

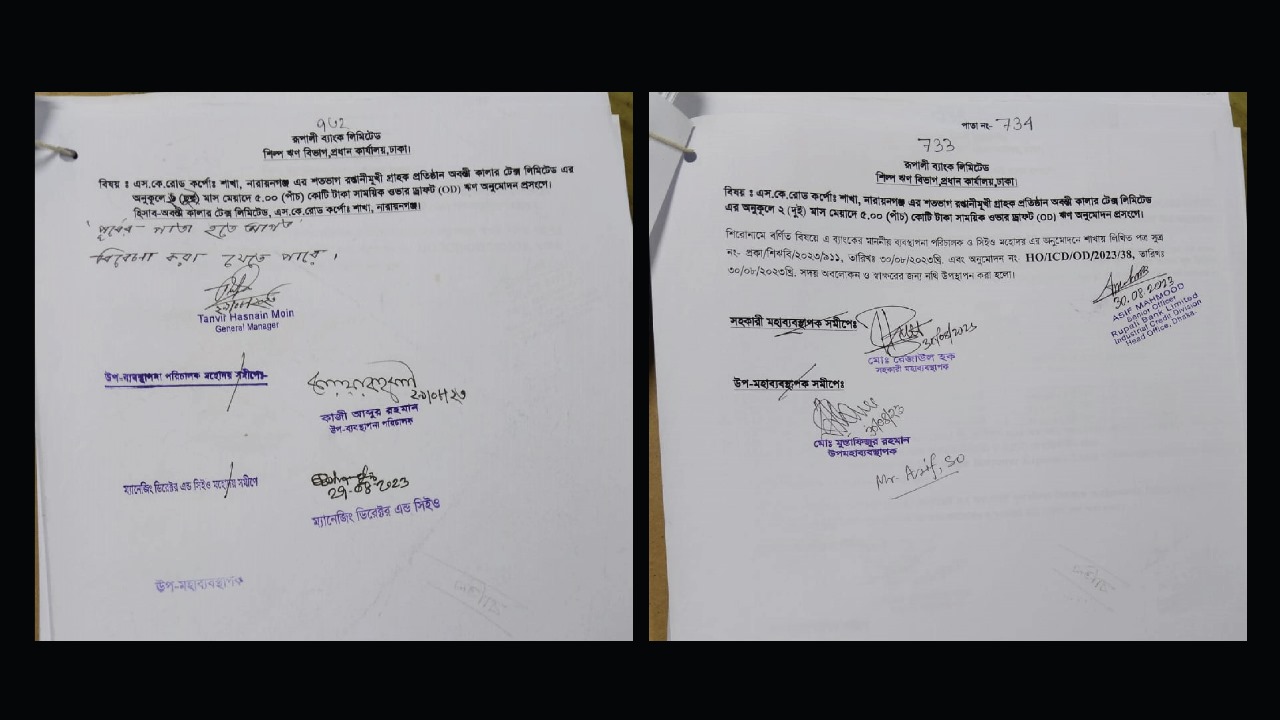

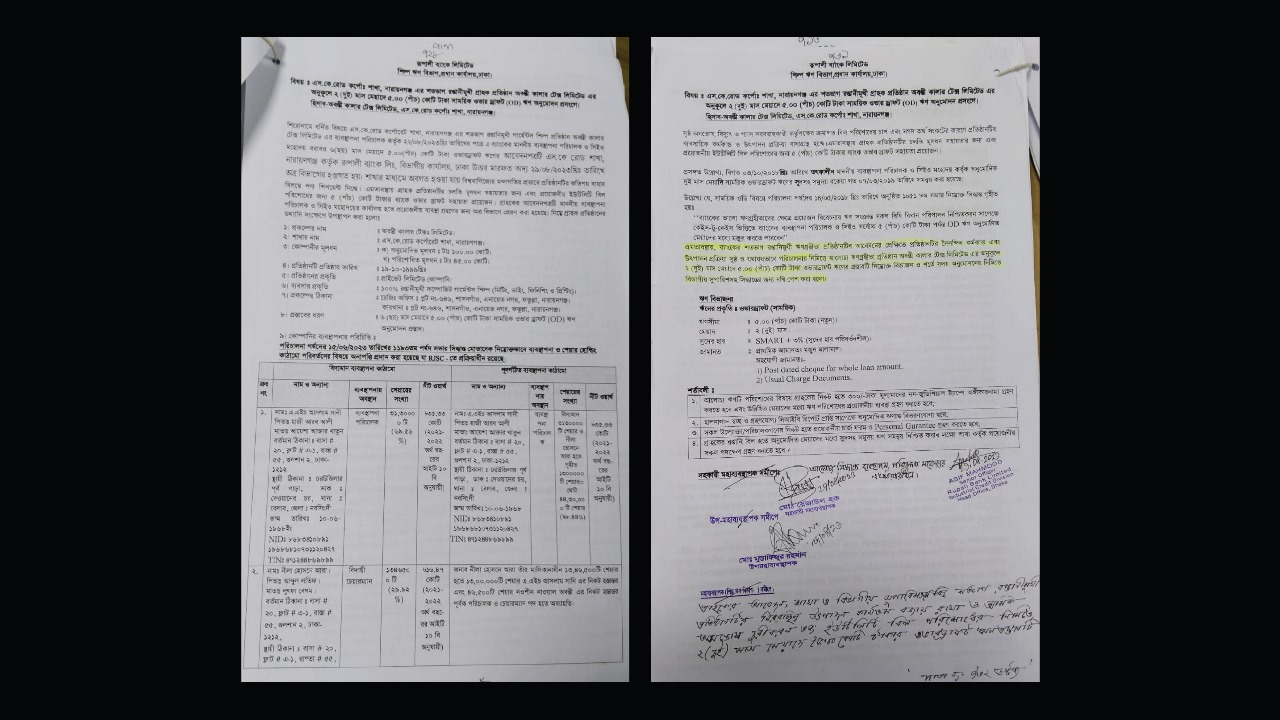

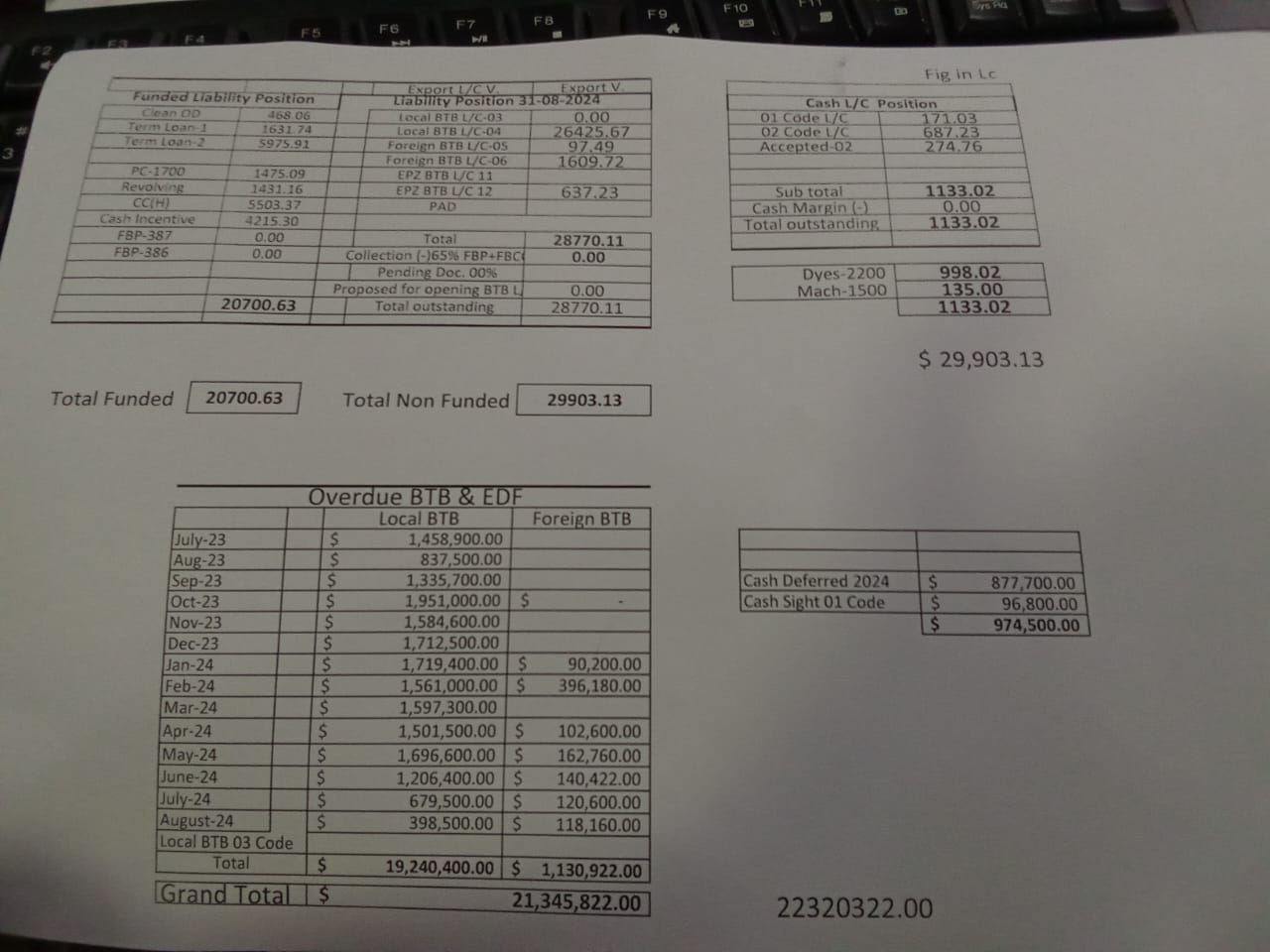

Former Rupali Bank Managing Director, Mohammad Jahangir, is facing serious allegations of financial misconduct, including the irregular approval of a five crore taka overdraft to Abanti Colour Tex Ltd, a struggling garment manufacturer with a history of outstanding debt.

This questionable loan was granted in August 2023, despite the company having an outstanding debt of USD $14,589,000 as of July 2023.

Sources reveal that Jahangir, who holds a third-class degree, bypassed established lending protocols and disregarded the company's existing financial liabilities when approving the overdraft.

Furthermore, allegations suggest direct communication between Jahangir and A.H. Aslam Sunny, Managing Director of Abanti Colour Tex Ltd., raising concerns about potential collusion.

This incident comes amidst broader scrutiny of state-owned banks in Bangladesh. In September 2023, the government terminated the contracts of six managing directors, including Jahangir, following concerns over financial irregularities.

Rupali Bank, the only state-owned bank

listed on the stock market, is now facing increased scrutiny over its lending

practices.

Adding to the controversy, Abanti Colour Tex Ltd. faced labor unrest in February 2024 when workers staged a six-hour strike at their Fatullah factory, demanding months of unpaid wages.

This incident further highlights the company's precarious financial situation and raises questions about the due diligence conducted by Rupali Bank before approving the substantial overdraft.

Bangla Outlook obtained all the documents supporting these allegations, potentially escalating this case into a financial scandal.

On May 14, 2018, a board meeting determined that the Managing Director is authorized to approve loans up to five crore taka for creditworthy clients, provided all regulatory guidelines are followed, including the stipulation that any existing debts must be settled first.

However, Jahangir's approval of a loan to

Abanti Colour Textiles seems to contravene these established regulations.

Attempts to contact Jahangir for clarification via phone have been unsuccessful.

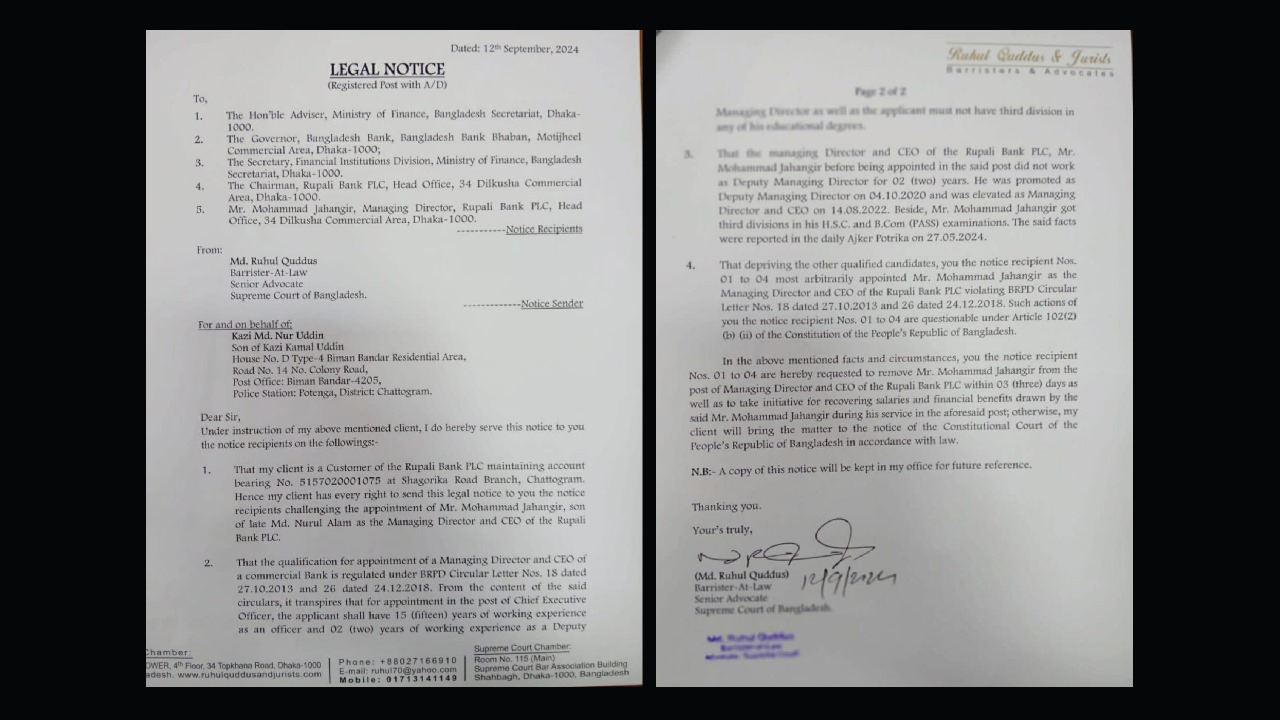

On September 12, a legal notice was issued to pertinent authorities, including the Finance Adviser’s office, the Chairman and Managing Director of Rupali Bank, and the Patenga police station in Chattogram, demanding Jahangir's removal from his post.

This notice, filed by Supreme Court lawyer Ruhul Quddus, underscores concerns regarding Jahangir's qualifications and the circumstances of his appointment.

While Jahangir has spent his entire career at Rupali Bank, questions about his educational credentials have emerged.

According to the current Managing

Director's profile on the Rupali Bank website, Mohammad Jahangir began his

banking career as an officer in 1990, a claim he has also made to the Financial

Institutions Division (FID).

However, the bank's Human Resource Policy from 2011 states that recruitment for officer positions was suspended for over 12 years due to the privatization of Rupali Bank Limited in 1986, with hiring only resuming in 1998.

Subsequently, officers and senior officers were recruited through the Bankers' Recruitment Committee (BRC) in 1998, 2000, 2001, and 2009. Given the lengthy hiatus in officer recruitment, significant questions arise regarding how Jahangir could have secured a position as an officer during that period.

Additionally, a circular issued by Bangladesh Bank in December 2018 clearly states that a third-class degree is not acceptable for the position of Chief Executive in a bank. Despite this, Jahangir holds both his higher secondary and bachelor’s degrees with third-class results.

His appointment as Managing Director in 2022, despite these deficiencies, raises significant concerns about compliance with regulatory standards.

According to the bank's human resource

policy, junior officers with a bachelor’s degree must have a minimum of two

years of relevant experience, and third-class degrees are not acceptable for

officer positions.

Furthermore, the rules specify that candidates for direct recruitment must possess at least a bachelor’s degree from a recognized university.

Jahangir’s advancement within the organization, particularly in light of these qualifications, appears to contravene these established protocols.

In a statement to Bangla Outlook, A.H. Aslam Sunny, Managing Director of Abanti Colour Tex Ltd., remarked, “We secured a loan against a bank guarantee for export purposes.”

He further emphasized, “Having been in business for the past 30 years, we’ve built a strong relationship with the bank. When a long-standing customer like us faces challenges in the export business, institutions like Rupali Bank should step up to support us, and that is exactly what they have done.”

—--