Second citizenship: How a plan B of Salman F Rahman and General Siddique went sour

In 2011, amidst Bangladesh's political turmoil caused by the Awami League-led parliament's controversial decision to eliminate the neutral caretaker government system for elections, Prime Minister Sheikh Hasina's two close allies were devising backup plans in case the situation deteriorated.

Salman Fazlur Rahman,

Hasina’s private industry and investment advisor, and Major General (Retd)

Tarique Ahmed Siddique, her security affairs advisor, attempted to obtain

second citizenship for themselves and their families, documents obtained by

Bangla Outlook revealed.

Salman F Rahman and General Siddique hold significant sway over Prime Minister Hasina's administration and her decisions. Salman effectively controls access to the country's private sector, while General Siddique wields substantial power over Bangladesh's military and intelligence apparatus.

The latter's brother

Shafique Ahmed Siddique is married to the PM Sheikh Hasina’s younger sister

Sheikh Rehana and their daughter Tulip Siddiq is a British member of the

parliament since 2015.

In late 2011, both Salman and Siddique, along with their wives, sought to acquire citizenship in St. Kitts and Nevis through the country's "Citizenship-by-Investment" program. They initiated this process via the global consultancy firm Henley & Partners (HPL)--Salman F Rahman through the Zurich office and general Siddique through the Dubai branch.

The appeal of this program was clear: a St. Kitts and Nevis passport offers extensive travel benefits, including visa-free access to 156 countries, and can be obtained relatively quickly for the applicant and their immediate family with an investment of $170,000.

However, both applications were ultimately rejected by HPL due to adverse findings in World-Check reports.

Why were the applications rejected?

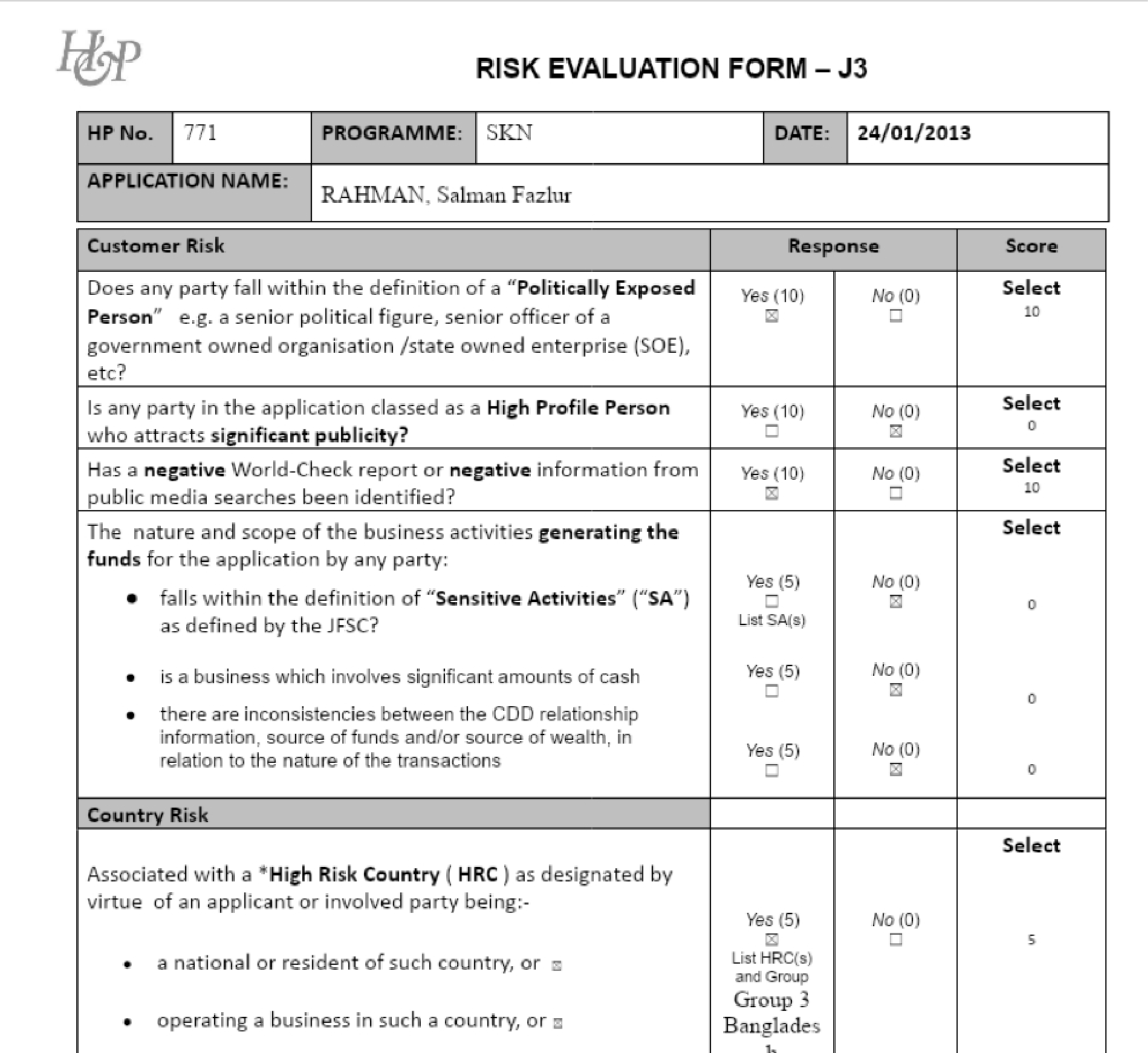

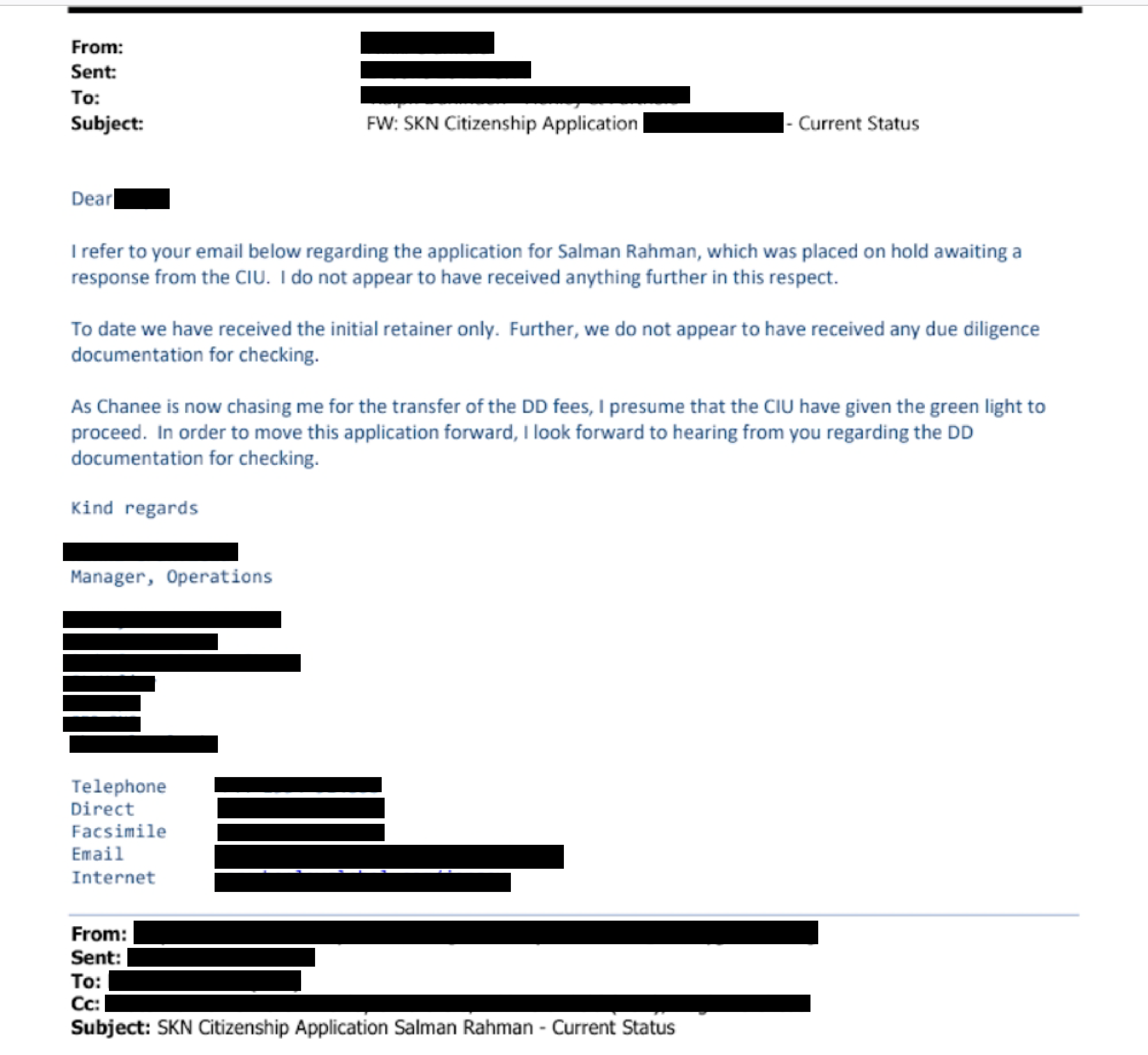

World-Check, a global

database used to assess financial and reputational risk, flagged Salman F

Rahman's application in 2013. An internal HPL email noted that Salman would not

be accepted as a client “due to various alleged offenses, including fraud, embezzlement,

and corruption, with links to organized crime, identified between 2007 and

2008.”

Despite Salman F Rahman providing explanations for the allegations raised by World-Check, HPL chose not to move forward with his application.

The internal HPL email indicated that this decision was based on the recommendation to refrain from proceeding until corruption charges against Salman, filed by the military-backed government in Bangladesh, were dropped or resolved. Subsequent to this, Bangla Outlook found no evidence of Salman pursuing further investment migration programs.

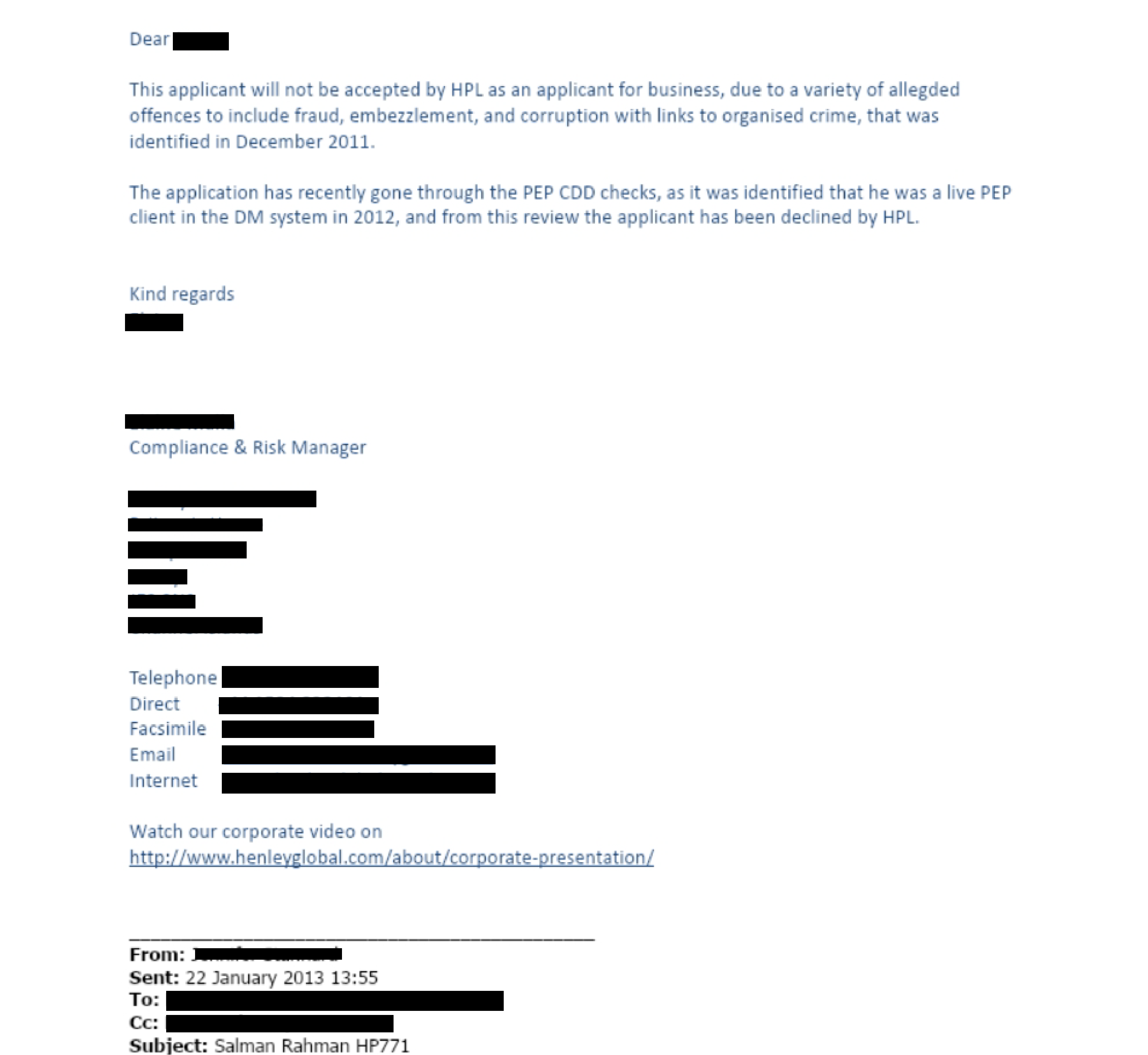

Siddiques reportedly

tried to obtain passports of other countries after failing to secure the St.

Kitts and Nevis citizenship, but those applications too were consistently

rejected due to General Tarique Siddique's status as a Politically Exposed

Person (PEP), a consequence of his position in the Prime Minister's Office.

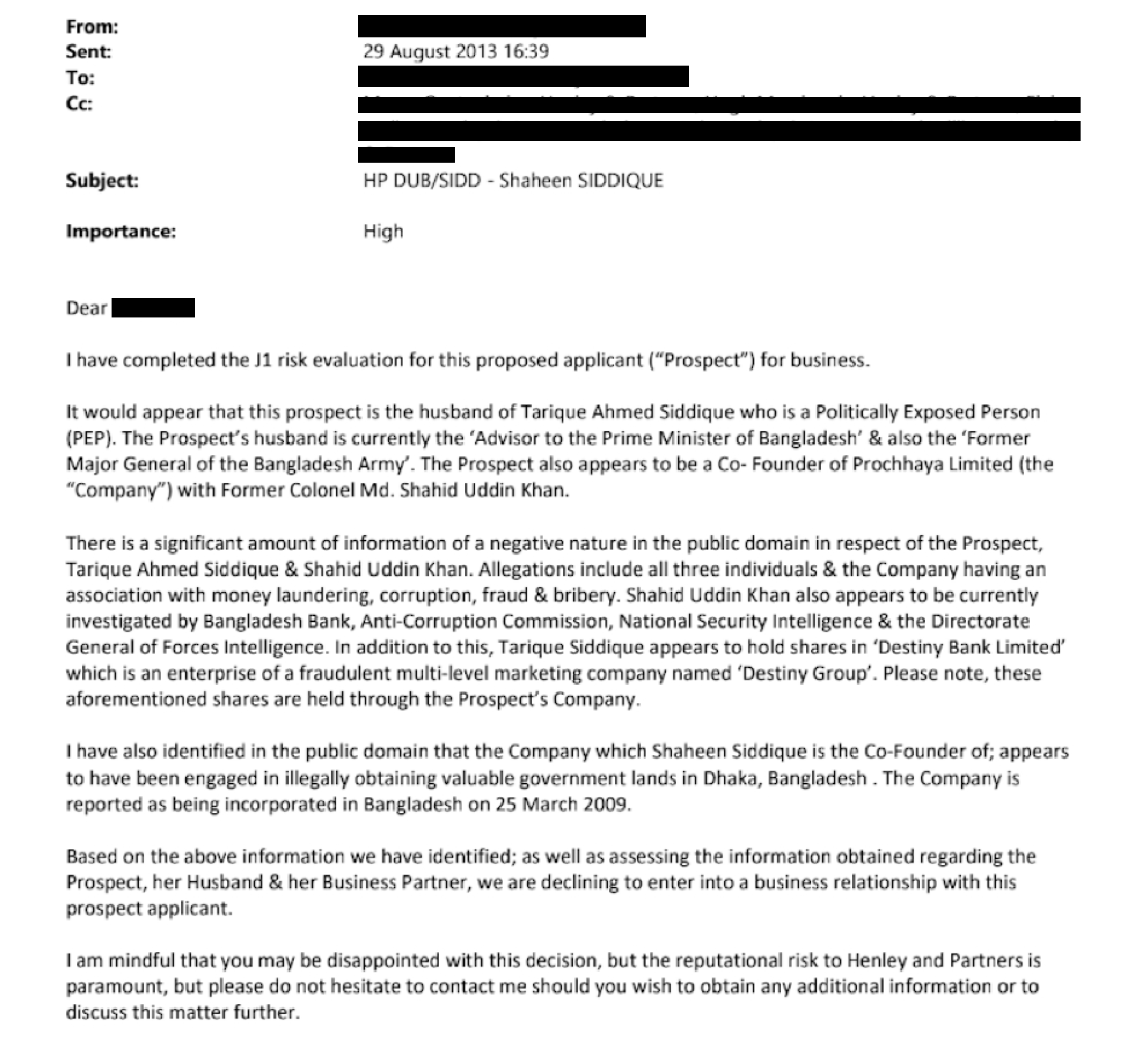

Additionally, Mrs [Shaheen] Siddique's co-founding of a controversial real estate company– Prochhaya in 2009, the same year her husband assumed his influential government role, raised further concerns. Prochhaya “appears to have been engaged in illegally obtaining valuable government lands in Dhaka, Bangladesh”, said the risk evaluation report dated August 29, 2013.

“There is a significant amount of information of a negative nature in the public domain in respect of the Prospect, Tarique Ahmed Siddique and Shahid Uddin Khan (another partner),” said the company’s risk evaluation report pointing out that all three individuals and the company Prochhaya are basically involved in money laundering, corruption, fraud, and bribery.

Further background checks also revealed Tarique Siddique owned shares in Destiny Bank Limited, a subsidiary of Destiny Group, a controversial multi-level marketing company led by a former army chief. These shares were held through Mrs. Siddique's company.

“Based on this information, combined with assessments of Mrs. Siddique, her husband, and her business partner, the decision was made to decline a business relationship with her,” noted the risk evaluation report.

Relentless persistence of the Siddiques

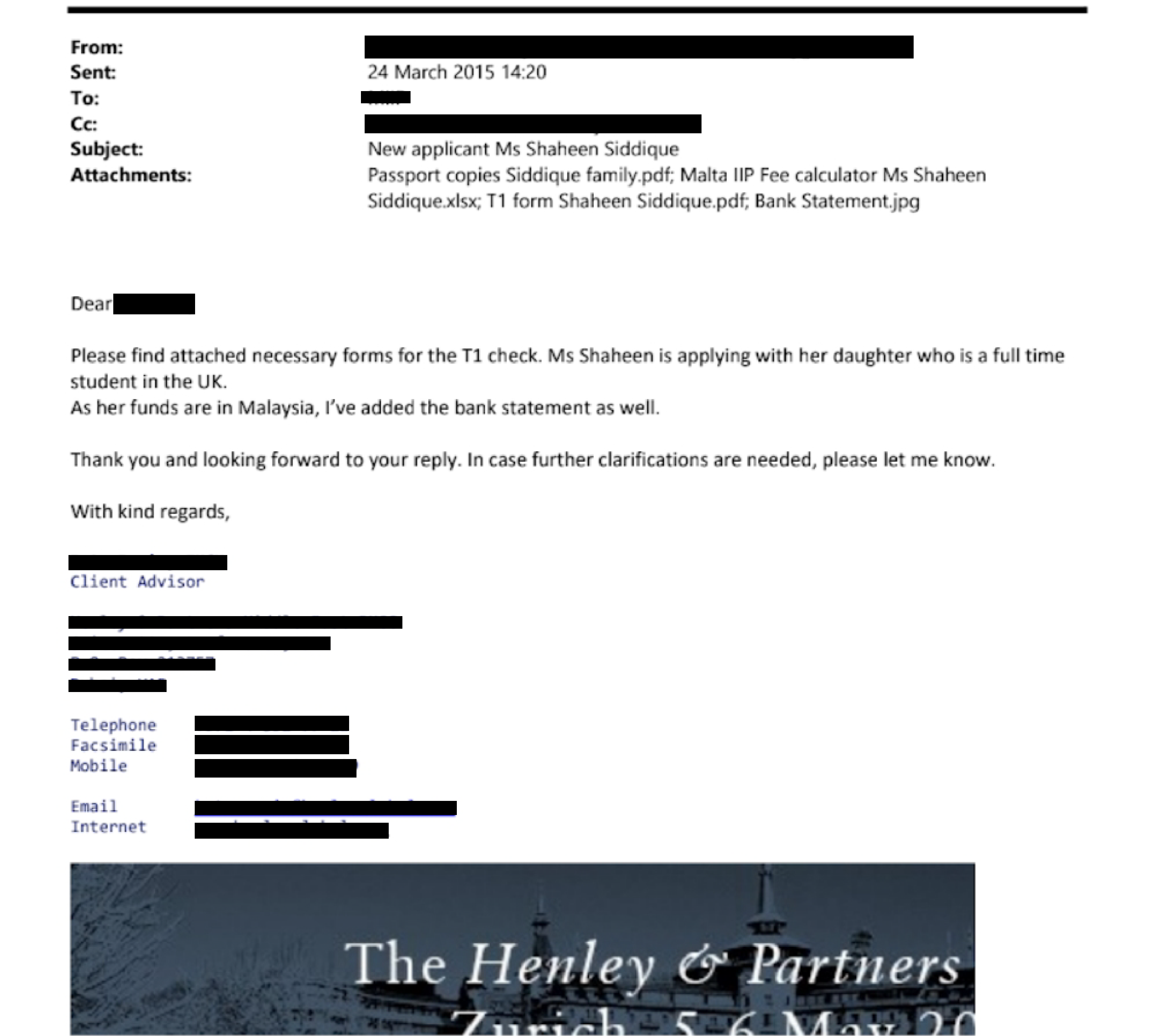

In October 2014, Mrs. Siddique and her younger daughter, Bushra Siddique, a director of Prochhaya and then an undergraduate student in the UK, applied for Maltese citizenship which offers the benefits of living and working anywhere in the EU, along with visa-free or visa-on-arrival access to 186 destinations.

The substantial investment required for Maltese citizenship in 2015 included a €650,000 payment from the main applicant, along with additional investments in property and bonds, plus further contributions for spouses and dependents.

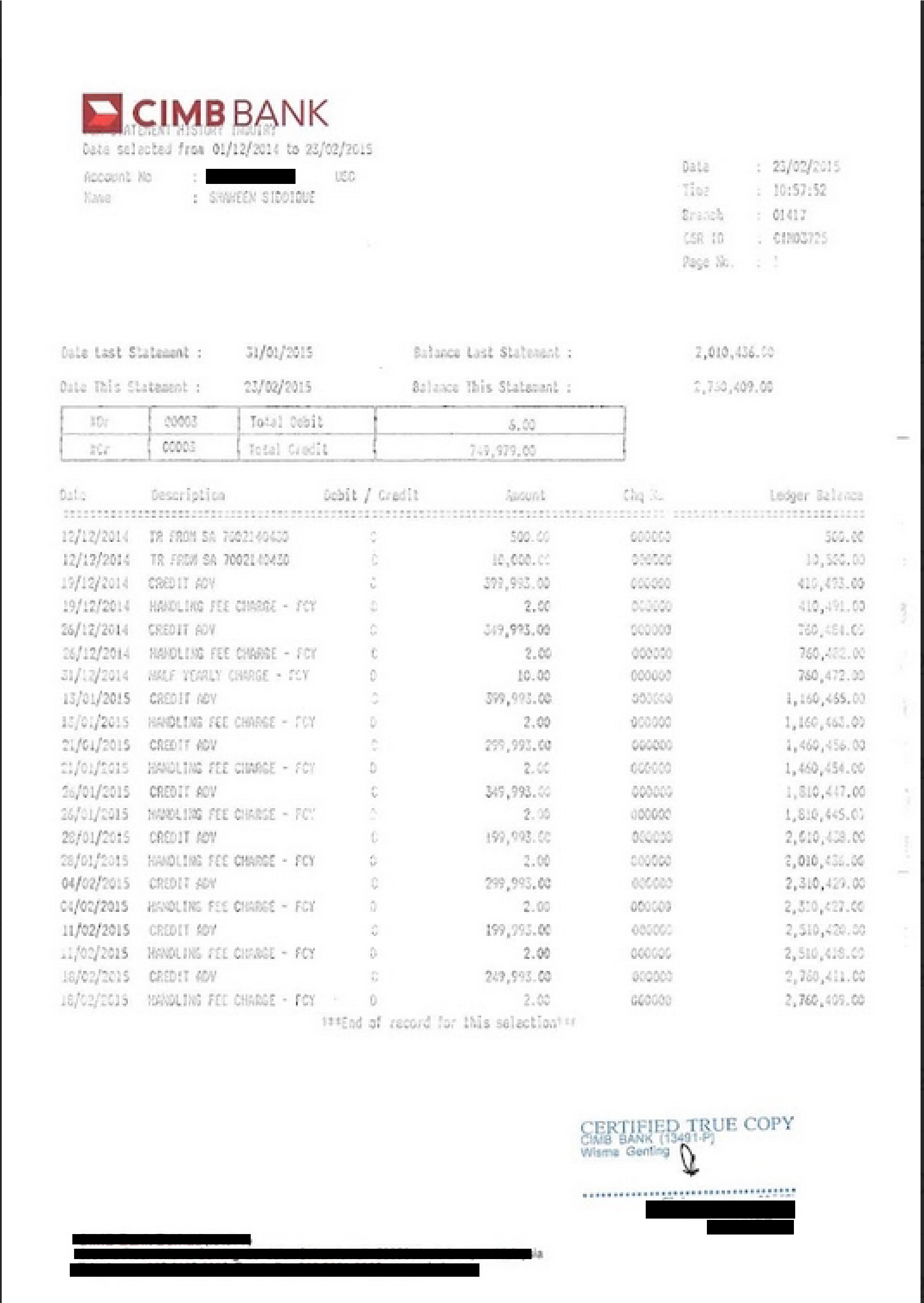

To bolster her

application, Mrs. Siddique submitted a bank statement from Malaysia's CIMB

Bank, a copy of which was obtained by Bangla Outlook.

The CIMB Bank account, with a mere $500 balance on December 12, 2014, inexplicably ballooned to $760,482 within two weeks. By February, prior to the Maltese citizenship application, it held a staggering $2.76 million, sufficient for Malta's investment requirement.

Despite the rejection of this application, the Siddiques persisted. In December 2015, they pursued Cyprus's golden passport scheme, offering citizenship for a minimum €2 million property investment. This attempt also ended in rejection.

The Siddiques however secured foreign residency for their younger daughter Bushra later on.

Bushra has lived in the

UK since completing her postgraduate degree from a British university in 2016,

when she joined the graduate program of an American investment bank halfway

through its three-year duration.

In July 2018, she and her husband, Mohammed Ashik Salam, bought a semi-detached house in London's upscale Golders Green neighborhood for roughly £2 million in cash. The couple, who were in their 20s at the time and had come to the UK on student visas, have raised questions about how they were able to afford such an expensive property with an all-cash purchase.

Meanwhile, the applications for foreign citizenship by Salman F Rahman and General Tarique Siddique present a comparable yet distinct dilemma.

The Bangladesh Bank only

allows funds to be sent abroad for medical and educational purposes, never for

foreign investments. This raises questions about how Salman and Siddique, both

Bangladeshi citizens and residents, were able to cover HPL's fees and expenses,

amounting to tens of thousands of dollars, and maintain foreign bank accounts

without violating the country's money laundering laws.

The country’s Central Bank has to approve overseas transfers, and buying a “foreign passport is not among purposes for which such approval can be obtained,” said Iftekhar Zaman, executive director of Transparency International’s Bangladesh chapter.

Paying for the passports would have been “absolutely illegal” if done with funds earned inside the country, said Ahsan H. Mansur, executive director of the Policy Research Institute of Bangladesh.

“It is not possible to take reasonably large sums of money out of Bangladesh because of capital account restrictions,” he said.

Neither Rahmans nor the Siddiques responded to requests for comment.

---