Leads Corporation's downfall: A saga of unpaid salaries, legal disputes, and suspected mismanagement

In late February of this year, Mizanur Rahman, a recently retired banker, received a call from a top executive at Leads Corporation, a leading software company in Bangladesh.

The executive briefly proposed a meeting at a restaurant to discuss Mizanur potentially becoming the CEO of the Leads and negotiating terms.

With experience as the former head of IT at three different national banks, Mizanur was familiar with Leads' operations and products.

Leads, along with Florabank, are the only two companies in Bangladesh that have been developing core banking software (CBS) for the country's banks over the past two decades.

CBS is the foundation of a bank's operations, centralizing all customer and financial data. It streamlines various banking services, ensures regulatory compliance, and facilitates informed decision-making.

However, designing and implementing CBS is a complex task that demands specialized programming knowledge, system architecture expertise, and substantial financial investment—a combination that most software companies in Bangladesh would struggle to provide.

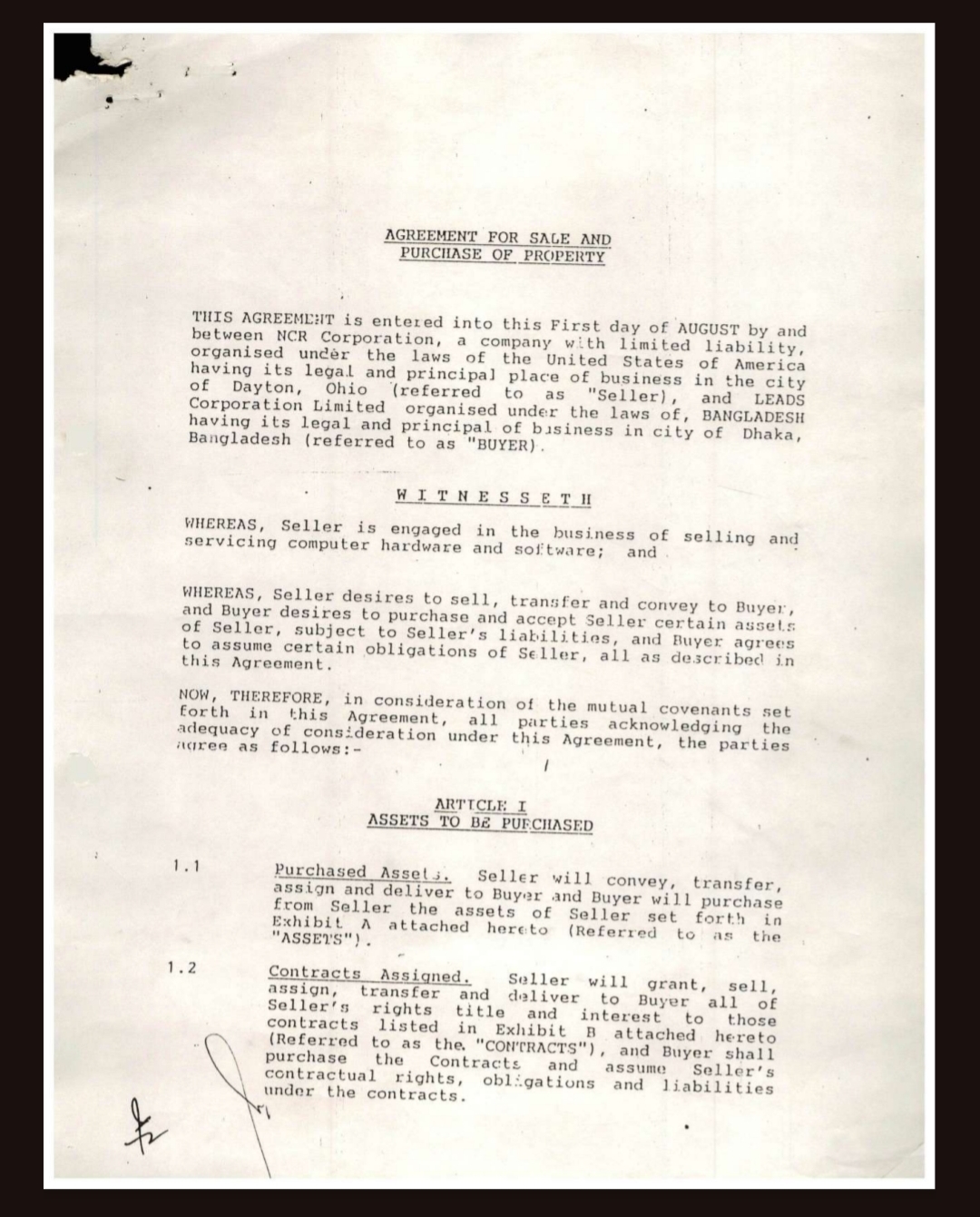

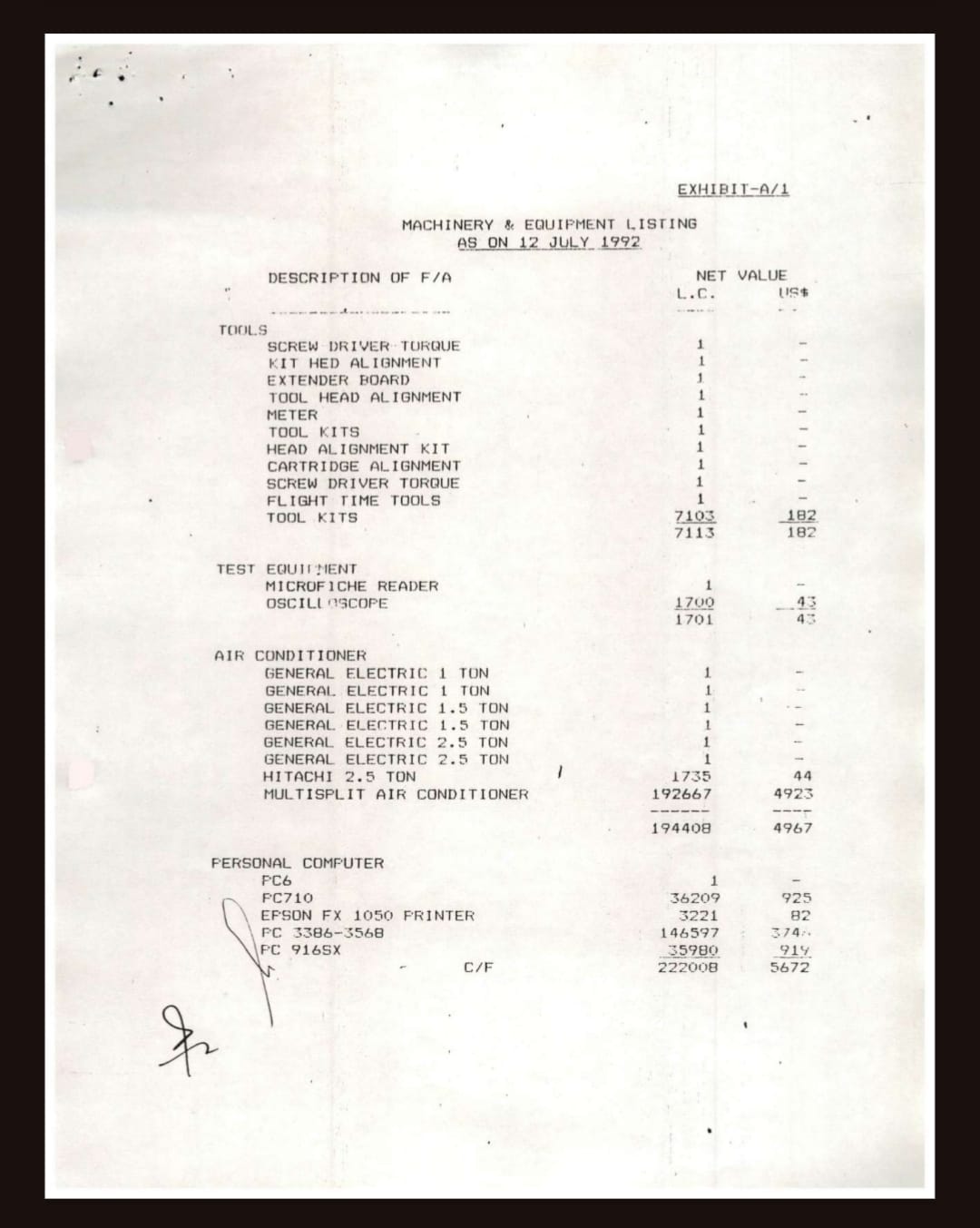

Leads Corporation, established in 1992 after purchasing the US-based software giant NCR's machineries in Bangladesh office, took a giant leap of faith and entered the CBS market in 1999.

The company's managing director, Shaikh Abdul Wahid, previously shared that NCR's strength in the financial sector, particularly with their ATM presence in several banks in the 90s, provided Leads with valuable knowledge about banking operations.

This expertise, gained through supporting NCR customers, led them to take the next step of designing their own CBS. “The decision to design and implement CBS was driven by an altruistic goal to replace foreign CBS with locally developed products,” Wahid once told this correspondent for a separate publication.

"I was quite familiar with Leads' products," Mizanur told Bangla Outlook. "As the IT head, I helped implement their CBS at one of the banks where I worked. However, the offer to become Leads Corporation's CEO didn't particularly excite me."

This was due to Leads' involvement in a unique legal entanglement that had not only depleted its funds but also left it in debt, resulting in months of unpaid employee salaries, totaling around Tk 40 crore.

Although Leads' financial struggles weren't public knowledge, Mizanur was aware of them as an industry insider. He knew the company was facing difficulties and a "strange case" was ongoing.

Nevertheless, driven by curiosity and a desire to salvage the sinking ship, Mizanur accepted the offer and became Leads' CEO in early March.

Legal tangles

Even before January of this year, Leads Corporation's legal trouble remained hidden from the public eye. Almost none of the 300 employees, half of whom were technical staff, had any inkling of the situation.

However, they sensed something was amiss when Leads, known for its timely salary payments, began experiencing irregularities in late 2018.

"We realized something was wrong in 2018 when our salaries became inconsistent," SM Saifur Rahman, the former COO of Leads Corporation, told Bangla Outlook. "But the board and owners reassured us that it was temporary and would be resolved soon."

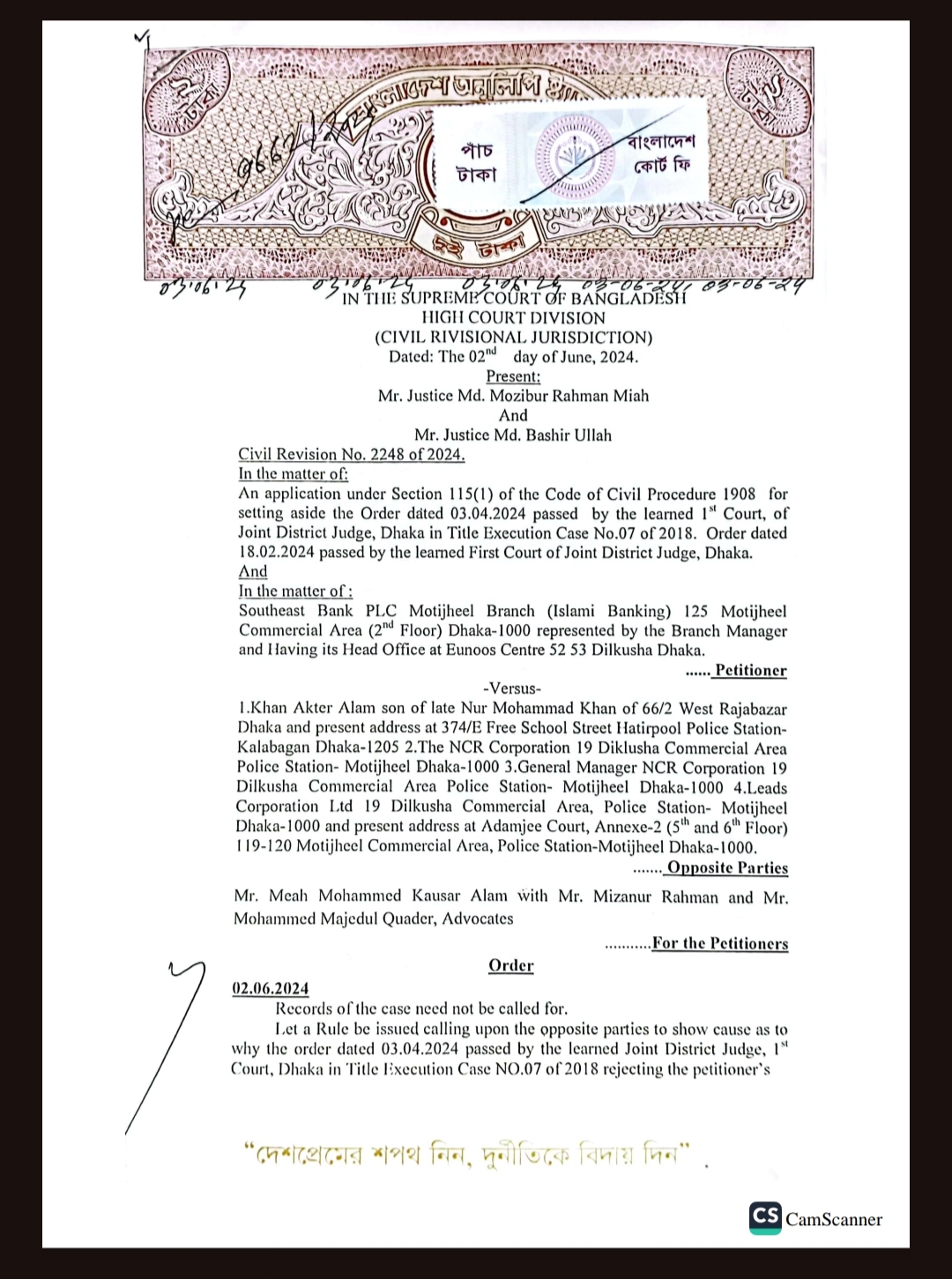

In early February, seemingly out of nowhere, Bank Ultimus, the core banking software (CBS) and primary product of Leads Corporation, was put up for auction under the order of Dhaka's Joint District Court-1.

The auction occurred because Leads failed to pay a due amount of approximately Tk 83 crore to a person named Khan Akter Alam.

“This was such a shock to us. It means that the main product that we are selling is no longer going to be ours. Which means we had nothing to sell anymore,” said Saifur who departed Leads this month after over 20 years of service.

His outstanding dues from the company exceed Tk 1 crore, and the prospect of receiving this amount seems increasingly unlikely as time goes on, he lamented.

The case filed against Leads Corporation by Khan Akter Alam is quite intriguing.

The roots of this conflict go back to 1992,

when Leads Corporation was established by acquiring machinery from NCR

Corporation's operations in Bangladesh. Khan Akter Alam, an employee of NCR

Corporation during the 1980s, was entitled to receive a commission on sales as

per the company's regulations.

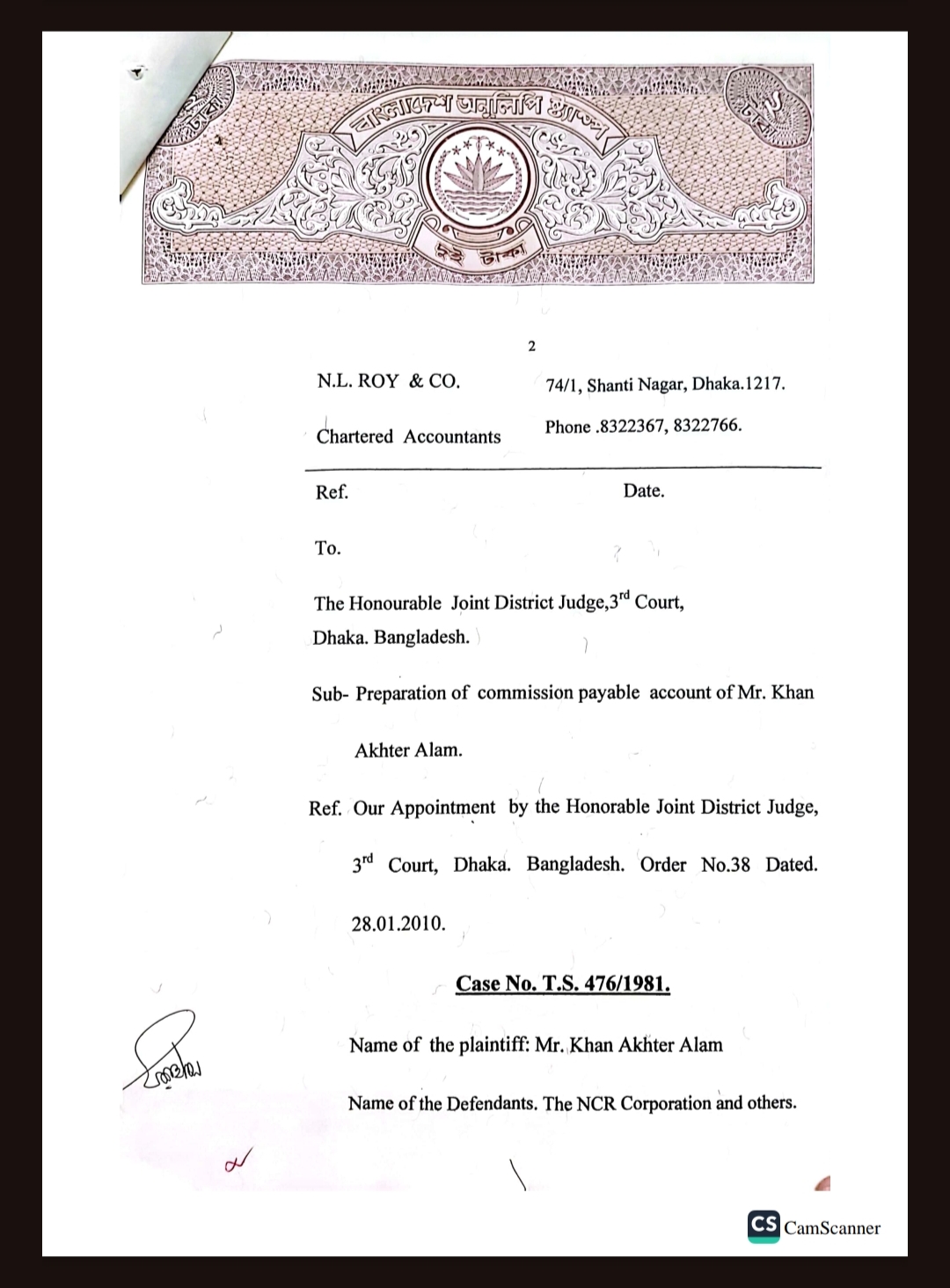

Due to non-payment of this sales commission, Khan Akter filed a lawsuit in 1981 seeking Tk 6.40 lakh from NCR, which he claimed as commission earned between 1972 and 1981.

Initially dismissed in 1986, Khan Akter appealed the decision in 1987. NCR Corporation meanwhile exited Bangladesh in 1992, transferring its machinery to set up Leads Corporation.

Legal representatives of Leads Corporation clarify that Leads did not acquire or merge with NCR Corporation. Instead, Leads purchased machinery from NCR without assuming any liabilities under the agreements.

Initially, Khan Akter did not make any claims against Leads Corporation. However, in 1999, he included Leads Corporation and NCR Corporation's zonal manager in his court documents. The Joint District Court-1 considered this in 2010.

Leads' top management initially dismissed the Khan Akter case, believing it to be NCR's sole responsibility and that the court wouldn't hold them liable for any financial compensation to Khan Akter.

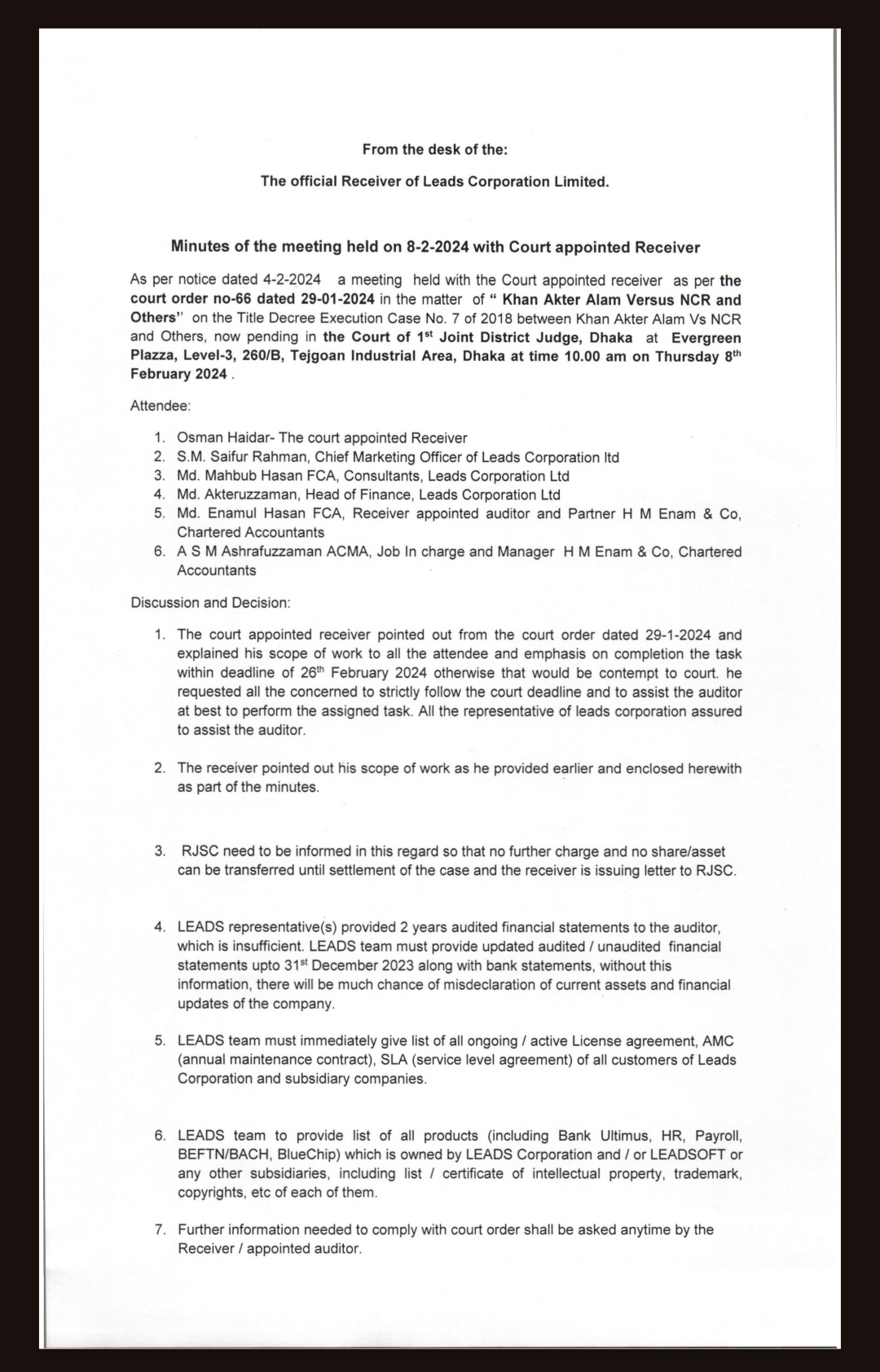

However, in 2010, the court ordered Leads to commission an audit report to assess Khan Akter Hossain's dues. N.L. Ray & Co., an external auditing firm, was appointed for this task.

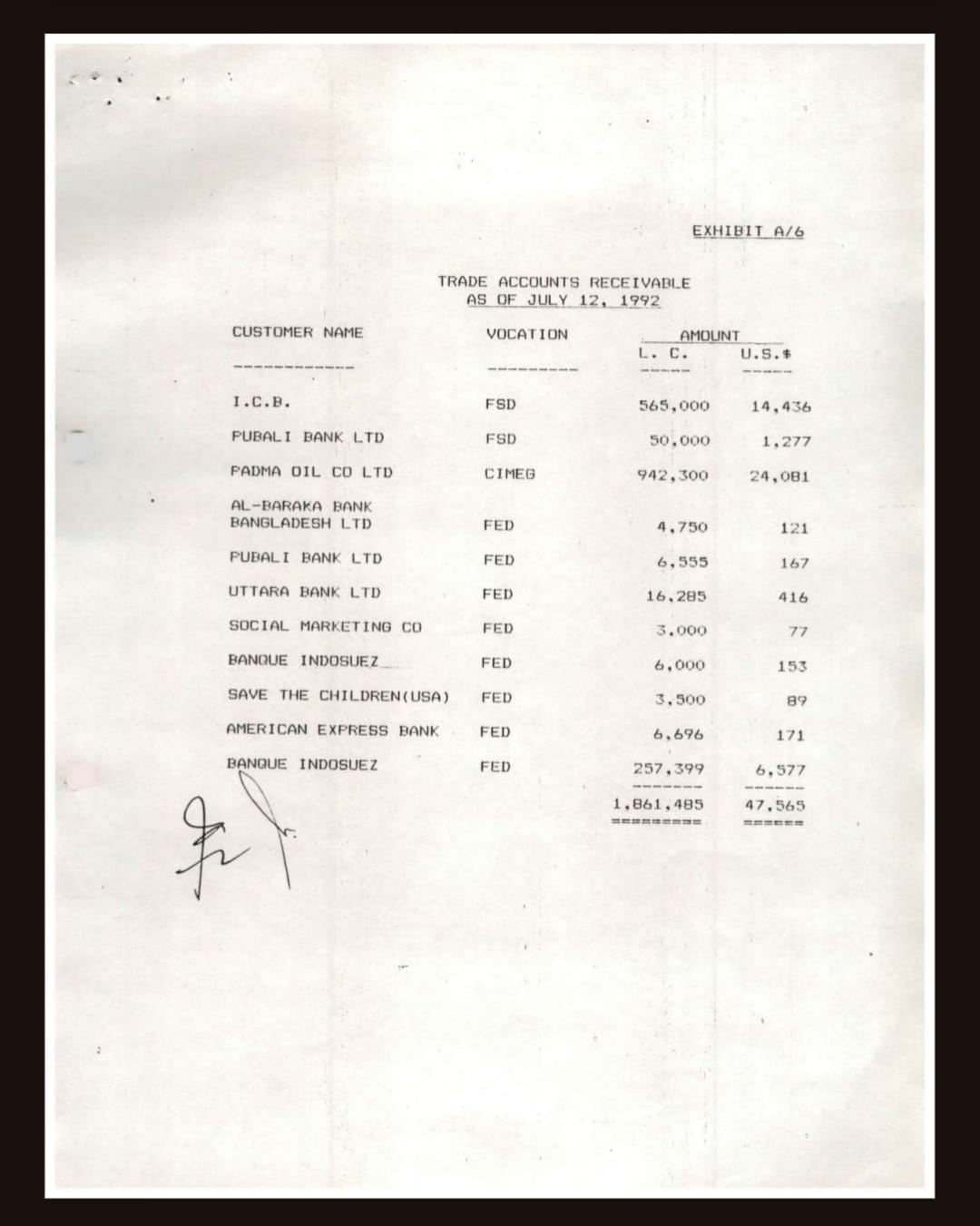

The audit, completed in the same year, determined his dues to be $720,000 with accumulated interest, which amounted to Tk 57 crore by 2018 when the Joint District Court-1 ordered Leads to pay Khan Akter his due compensation.

Bangla Outlook tried to contact Khan Akter Alam for his comments on this but he declined to speak on this issue.

“You understand that a Dhaka court had asked Leads to pay a substantial amount of money back in 2018 and as employees we were completely in the dark about this,” Saifur told Bangla Outloook, “Up until late January this year.”.

In February, an auction notice was issued, stating the dues of Khan Akter had reached Tk 83 crore 66 lakh 92 thousand 134 taka at an exchange rate of 115 taka per dollar and to pay the dues, Bank Ultimus, the CBS product of Leads, would be auctioned.

The auction had taken place and Bank Ultimus was bought by Florabank, the only rival of Leads’ in Bangladesh’s CBS market, for just Tk 5 crore.

Employee woes

The gleaming office tower of Leads' Corporation, an iconic landmark in Dhaka's Mirpur since its opening in 2022, marked a significant milestone for the company after two decades of moving between locations.

In a country where most software companies operate out of cramped residential apartments, Leads' glass and steel building stood out as a welcome anomaly.

Leads' employees enjoyed a generous compensation package, envied by many in Bangladesh's tech industry, and were proud of their modern workspace.

Arifur Amran Chowdhury, formerly a system architect at Leads Corporation, cherished the company's prosperous days. In 2014, following a freakish accident that left both his legs fractured, he received Tk 3 lakh for medical expenses from Leads.

"I received the full amount within a week of submitting my bills to the finance and accounting department at Leads. It was smooth and without any delays," reminisced Arifur.

However, since 2018, the situation has taken a drastic turn. "Salaries became irregular, often delayed by three to four months. We live our lives from paycheck to paycheck, and without a regular salary, it was becoming increasingly challenging for us," Arifur lamented.

By early 2023, Arifur decided to leave Leads and join another IT firm. "Now, my outstanding dues from Leads exceed Tk 17 lakh, and I see little hope of recovering that money, especially since Bank Ultimus is no longer associated with Leads."

What perplexed Arifur, along with many other Leads employees, was their lack of awareness regarding the company's legal troubles.

"Looking back, everything now falls into place. The legal issues began in 2018, coinciding with salary problems. Whenever we questioned management about irregular pay, they often cited bank loans that needed repayment and promised regularization soon."

Even top officials like Saifur weren't aware of these legal troubles. During his two decade-long stint in Leads, he had climbed the ladder gradually and was the Chief Marketing Officer (CMO) when the legal trouble of Lead’s started mounting in 2018.

“The monthly salary of Leads was around Tk 2 crore and we were having a regular collection of Tk 6-7 crore from different banks and financial institutions which are using our CBS. So, the math was very simple and we were always in green,” said Saifur.

“But, whenever we asked the finance department about employee dues, they replied that the owners were diverting a large chunk of funds for bank loan payments. They however used to say that the problem was temporary and it would be resolved soon,” Saifur Added.

Abdullah Al Mamun, a former Assistant General Manager of Leads Corporation believed the problem with the company started when Sheikh Abdul Wahid joined Leads as its managing director.

Sheikh Wahid, a graduate in business management from Dhaka College, joined NCR Corporation's US head office and later served as principal officer in various countries across Central and Eastern Europe.

In 2015, he eventually returned to Bangladesh to join Leads Corporation, a company founded in 1992 by his elder brother, Sheikh Abdul Aziz. Prior to establishing Leads Corporation, Sheikh Aziz had a successful career as national sales manager for British American Tobacco Bangladesh (BATB) and experience in the garment industry.

“Aziz [Shaheb] had a root in Bangladesh, unlike his brother Sheikh Wahid, who worked in the US and Europe for most part of his career. All of his family members also live abroad. We, the employees, started to feel that Wahid [Shaheb] has some sort of disconnection with the company,” said the former AGM Abdullah Al Mamun.

Abdullah too left Leads in late 2022 and joined another IT farm. He gets around Tk 35 lakh from Leads which he believes the company would never be able to “pay anymore.”

Sinking ship

When Mizanur took over Leads in March, his top priorities were to resolve nearly Tk 40 crore in unpaid employee dues and address the legal complications with Khan Akter.

He discovered that all of Leads Corporation's bank accounts had been frozen since February, with payments for its CBS service being directed to a court-appointed receiver.

Despite this, Mizanur's review of financial records showed that Leads typically received Tk 4-5 crore per month before the account freeze, while employee salaries amounted to only Tk 1.5 crore. This indicated that Leads had sufficient funds to cover the dues but failed to do so.

“It’s so baffling. Records showed Leads had enough money, but the money was gone,” Mizanur told Bangla Outlook, “It seemed that the money was shifted somewhere else, possibly out of the country.”

Bangla Outlook reached out to Sheikh Wahid, now residing in the US, to inquire about Leads Corporation's failure to pay employee dues. Wahid avoided a direct answer, vaguely stating that the dues would be cleared "very soon."

In an email to Leads employees last week, Wahid announced the removal of CEO Mizanur for failing to lead the company effectively and urged all employees to return to work.

"That email was absurd," Mizanur remarked. "I stopped going to the office last month because I realized Leads' financial and legal problems were orchestrated by its owners and were beyond fixing."

He further commented, "Asking employees to return to work with empty promises was another cruel joke by the owners."

Meanwhile, Sheikh Wahid shared with Bangla Outlook his suspicion of a corporate espionage plot by Florabank, Leads Corporation's main competitor. Currently, Florabank provides CBS solutions to 10 banks, while Leads serves 13 banks with its Bank Ultimus software.

Wahid, who along with his brother is 80 years old and resides outside Bangladesh, alleged that their vulnerability is being exploited to seize control of the company through an unrelated past case.

He claimed Florabank was exerting undue pressure and manipulating an auction process to acquire their core banking software services.

Mustafa Rafiqul Islam, known as "Duke," is the charismatic owner of Florabank and a computer science graduate from Purdue University. He is one of the few IT entrepreneurs of the country who actually understands what happens inside the world of bits and bytes, not just the block diagrams.

Regarding Sheikh Wahid's allegation of corporate espionage, Duke refutes it, stating that Florabank legally acquired the Bank Ultimus software through a court-ordered auction. He emphasizes that they followed the law in acquiring the intellectual property rights and didn’t do anything wrong.

"I'm unaware of the specific actions the Leads owners took to put their company in that predicament. It's not something I concern myself with. I had an opportunity to acquire my competitor's core product, and I took it. This is fairly common in the corporate world, particularly in the tech industry," Duke explained.

Meanwhile, users of the Bank Ultimus software are growing anxious. CBS is a critical system for banks, and their daily operations rely heavily on its smooth functioning. Providers like Leads or Florabank are essential for ongoing software maintenance after deployment.

With most of Leads' technical staff having left the company, there's widespread concern that client banks will face difficulties in the near future.

Md. Rafiqul Islam, managing director of Uttara Bank, which uses Bank Ultimus, highlights the potential nationwide impact of the Leads Corporation crisis. He warns that any sudden disruption in software services would cause major operational problems.

"Replacing the software provider isn't a simple or fast solution," he said. "The consequences could extend beyond the company, becoming a national issue and damaging the reputation of the domestic software industry."

Bangladesh Bank spokesperson Mejbah Ul Haque assured that the central bank has ICT guidelines in place to assist banks in dealing with such software-related challenges.

He also stated that “a reduction in IT staff at software companies” wouldn't have “an immediate impact” on banks' daily operations, but it could potentially “delay the launch of new products or software updates.”

Florabank’s Duke meanwhile said that since

they have acquired Bank Ultimus, they would develop a workforce and manual for

it. “We might urge the banks using Bank Ultimus to switch to our software as

well.”

—