The watchmen watched: Tax probe exposes Elite Security’s financial misconduct

-680fb4f86d200.jpeg)

On the bustling streets of Dhaka, where private banks, corporate houses, and residential compounds are shadowed by rising anxieties over safety, the first line of defense usually stands five and half feet tall.

Perhaps no figure is more ubiquitous than these private security guards–the majority of whom are supplied by a firm called Elite Security Services Limited (ESSL), identified by their navy blue trousers, light blue shirt, checkered tie and the distinnctive "Elite Force" monogram on their chests.

But behind the quiet discipline and meager pay of these men– many of whom stand watch for hours armed with nothing more than a baton, a whistle, or a rolled-up newspaper– lies this company that’s not quite as transparent as its branding suggests.

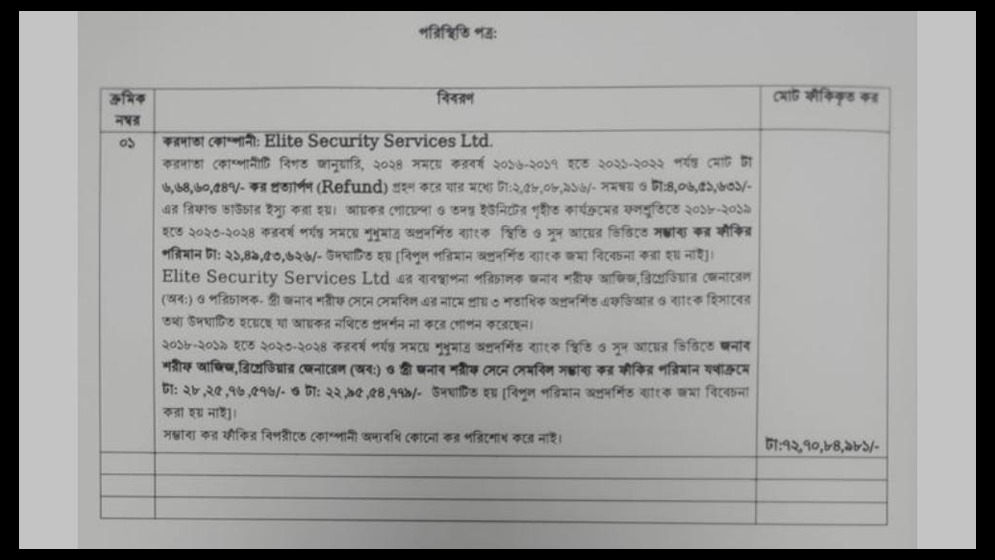

ESSL is now facing serious allegations of massive financial misconduct. An investigation by Bangla Outlook has revealed that the firm’s owners have systematically obscured their financial records, concealing the existence of multiple bank accounts, underreporting balances, and withholding information about vast fixed and personal assets.

According to internal findings from the National Board of Revenue (NBR), the company is suspected of laundering and sheltering over 14.5 billion taka (roughly $132 million) in unreported assets over the past seven years.

The findings, included in a progress report by the tax intelligence unit submitted to the Ministry of Finance, point to “deliberate misrepresentation of financial information under the cover of a registered security company.”

The scale of tax evasion could run into the hundreds of crores of taka, raising alarms not just about Elite’s accounting, but about regulatory blind spots across Bangladesh’s booming private security sector.

Elite Security’s reach is hard to overstate. It provides guards to dozens of high-profile banks, shopping centers, and office buildings in the capital and beyond.

Yet, the very workers who make the company visible on every corner live far from the wealth it seems to amass.

Anomalies in company book, bank

account

In Karwan Bazar, one of Dhaka’s commercial hubs, Bangla Outlook spoke to two Elite guards stationed outside a private office tower.

“We are on duty for eight to twelve hours a day,” said one, requesting anonymity. “Our salary depends on where we are posted — maybe 8,000 taka, sometimes 12 or 16 [about $75 to $150 a month]. Most of us do overtime just to survive.”

The guards receive no health insurance, no pension plan, and often no guarantee of raises. The firm’s own website boasted a workforce of 22,500 guards like them in 2023.

If each is paid a modest average salary of 10,000 taka per month — a conservative estimate — the company’s monthly wage bill would total 225 million taka, or 2.7 billion taka annually. And that’s just the beginning.

Elite also operates three training academies, maintains between 15 and 20 canine units, and employs a sizable cadre of officers and administrative staff.

Taken together, operational expenditures should reasonably amount to several hundred crore taka annually. And yet, the company’s financial disclosures tell a different story.

In its filing for the 2023–24 tax year, Elite Security reported total revenues of just 136.16 crore taka, against expenses of 133.82 crore — yielding a thin profit margin of 2.34 crore taka.

For a firm of its scale and national footprint, the numbers are deeply at odds with ground realities. In fact, this pattern of underreporting has persisted for at least seven years.

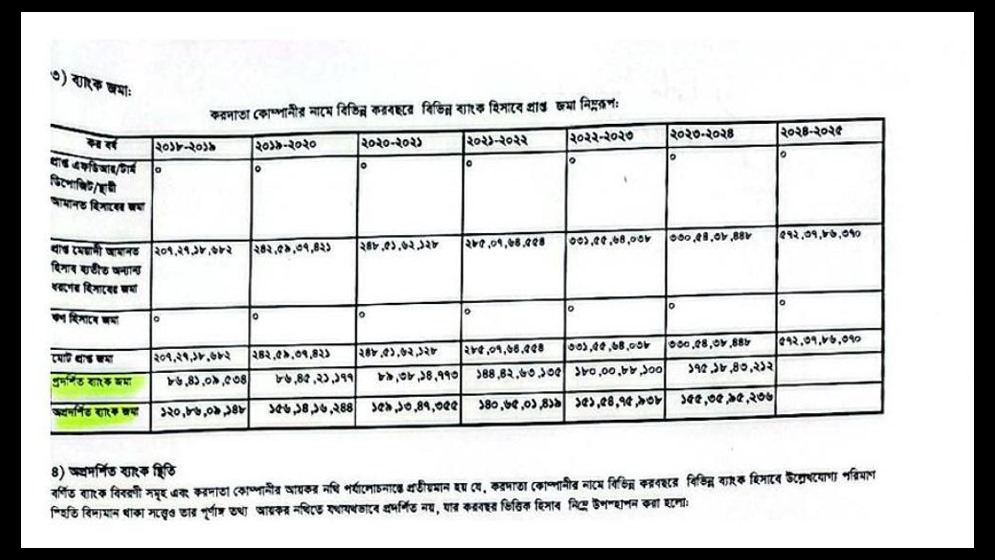

According to a report from the National Board of Revenue’s tax intelligence unit, the company claimed to operate just nine bank accounts in its returns.

But when investigators contacted all scheduled banks and financial institutions, a different picture emerged: Elite was linked to at least 37 bank accounts — meaning three-quarters of its financial channels were left out of official disclosures.

The implications are staggering. Over the past seven years, those hidden accounts saw deposits totaling 22.17 billion taka. But only 7.61 billion taka was reported. In short, Elite concealed over 14.5 billion taka — nearly $132 million — from tax authorities.

As for current bank balances, the company's filings show just 443.4 million taka. Investigators found the actual figure to be more than four times that: 1.99 billion taka. The interest earned on those deposits — another key source of taxable income — was also left undeclared.

Tax authorities estimate that at least 225 million taka in taxes was evaded through this concealment. That figure could rise significantly once penalties and accumulated interest are included.

Tax investigators have uncovered multiple undisclosed properties and operations of Elite Security Services Limited across Dhaka’s upscale neighborhoods, including Gulshan, Baridhara, and Nadda as well.

While the company officially acknowledges just one office and three training academies, none of these facilities appear in its income tax filings.

Each academy, situated on approximately two bighas of land, is estimated to be worth several hundred crore taka — assets that remain absent from the company’s declared financial statements.

A family business, a web

of concealment

Elite Security is a tightly held family enterprise founded in 1999 by Brigadier General (Retd.) Sharif Aziz, who remains its managing director.

His wife, Sharif Sene Sembil, son Sharif Shamam Al Wafi, and daughter Sharif Juena Zaim serve as company directors.

Despite the family’s visible control over one of the country's largest private security firms, their personal financial disclosures tell a vastly incomplete story.

In their income tax returns, Sharif Aziz and Sharif Sene Sembil listed only three bank accounts. But records obtained by tax authorities from financial institutions tell a different tale: the couple is linked to over 300 individual and joint accounts.

Among the concealed assets are fixed deposit receipts (FDRs) worth 1.61 billion taka in Sharif Sene Sembil’s name, along with an additional 576.4 million taka held in other forms across various banks. In Sharif Aziz’s concealed accounts, investigators found 2.13 billion taka in FDRs and another 532.6 million taka in cash or liquid assets.

This reporter has also reviewed the couple’s 2023–24 income tax filings. Sharif Aziz declared total assets of 160.5 million taka, an annual income of 7.5 million taka, and tax paid of 1.948 million taka. His wife reported legal assets worth 76.4 million taka, with 6.639 million taka in income and 1.366 million taka in tax payments. Yet their actual holdings — including multiple properties across Dhaka and beyond — suggest far greater wealth than declared.

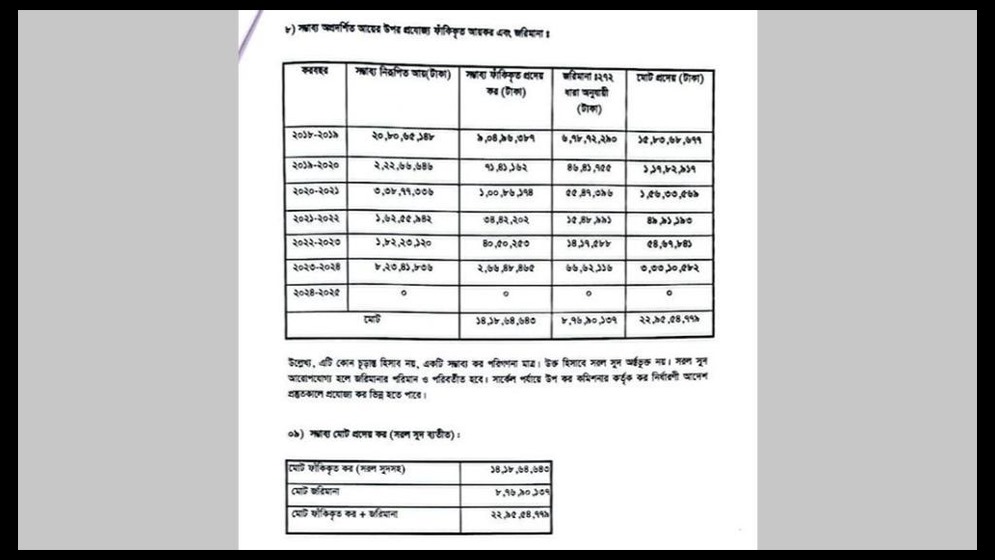

According to the NBR, the couple has systematically underreported income and assets from the 2018–19 to 2023–24 tax years. Tax officials estimate that Sharif Aziz evaded 282.5 million taka in taxes, while Sharif Sene Sembil evaded 229.5 million taka.

These figures do not even account for the full volume of undeclared deposits and interest income hidden in their sprawling network of bank accounts.

Meanwhile, Elite Security’s own tax filings raise further questions. The company’s clients — primarily banks, corporations, and other institutions — pay service fees via bank transfers.

At the time of payment, taxes are automatically deducted at source and deposited with the government. That amount is later reconciled with the company’s final tax bill.

Unanswered questions

Over the past seven years, Elite Security received 66.6 million taka in refunds for tax deducted at source, according to investigators.

Of this, 25 million taka was used to offset the company’s final tax liability, while the remaining 41.6 million taka was refunded by check — a move that suggests meticulous gaming of the system even as larger sums were concealed.

The Ministry of Finance has been informed by the NBR tax intelligence unit that the investigation into Elite Security Services Limited remains ongoing and will require additional time to complete.

Nonetheless, an interim report detailing initial findings has already been submitted to the ministry.

Investigators say they have repeatedly questioned those at the center of the case — including senior figures from Elite Security — but received no satisfactory responses.

According to the report, the scale of the concealed wealth raises suspicions that some of the assets may have been amassed through bribery, corruption, or illicit dealings with powerful individuals.

Tax officials further suspect that current or former members of the military and civil administration may be linked to the undeclared assets — either as beneficiaries or silent partners. Investigators believe that a deeper probe into the company’s extensive network of bank accounts could help uncover the identities of these figures.

Reached by phone for comment, Brigadier General (Retd.) Sharif Aziz, founder and managing director of Elite Security Services, confirmed he is in communication with the tax authorities. “Thank you for calling. We are contesting the allegations,” he said.

Pressed further, Aziz added defiantly: “You say we have evaded taxes — then let them arrest us. If needed, record what I’m saying and let the public hear it. No problem.”

—-