Shell firms, silent transfers, and missing oversight: Inside Nagad’s financial maze of corruption

When Nagad burst onto the scene in Bangladesh’s mobile financial services (MFS) industry, it marketed itself as a bold new “disruptor” in a sector long dominated by a single major player.

Backed by sleek branding and aggressive expansion, the company claimed to be driving the country's transition to digital finance. But as recent findings suggest, the rise of Nagad owed more to political patronage and regulatory leniency than to innovation alone.

With quiet but substantial support from the Awami League government, Nagad received unprecedented state facilitation–what critics now describe as "unwarranted blessings." Publicly framed as a push to digitize financial transactions and increase access to fintech services, the initiative helped Nagad scale rapidly.

However, behind the curtain of state-endorsed success, investigators have uncovered troubling evidence of financial misconduct, opaque ownership, and regulatory evasion.

Since its inception, questions swirled around the true ownership of Nagad. For years, there was confusion over whether the MFS provider was owned by Bangladesh’s Department of Posts and Telecommunications or the private firm Third Wave Technologies Ltd.

The ambiguity was resolved only on August 16, 2021, in a high-level inter-agency meeting. But while the formal ownership question may have been settled, a far more complex set of issues lay hidden beneath the surface.

Those irregularities began to surface only after the Awami League’s fall from power in August of last year. An inspection by a newly appointed oversight committee–installed by Bangladesh Bank–uncovered what insiders now describe as widespread financial discrepancies and structural malpractice within Nagad.

A particularly damning finding was a reported deficit of 2,356 crore taka, roughly $200 million, within Nagad's internal accounting. The inspection report, which Bangla Outlook has obtained, indicates that Nagad generated excessive electronic money, or "e-money," by artificially inflating its agent and distributor figures.

These ghost entities, officials believe, allowed the company to generate digital cash without corresponding deposits.

The scrutiny has also turned to Nagad’s investors–specifically, Fintech Holdings Ltd., which reportedly holds a 3.2% stake in the company, worth around 54.4 million taka. Official documents list Fintech Holdings as a software service provider offering financial solutions and advisory services.

But a visit to the address listed with the Registrar of Joint Stock Companies and Firms (RJSC)--Delta Dalia Tower, 36 Kamal Ataturk Avenue, Banani–revealed that no such firm exists at the location. While Nagad’s head office operates from the building, the management said they had no knowledge of any entity by that name.

"I’ve been the building manager here for seven years,” said Rafiqul Islam, the tower’s property supervisor. “But I’ve never heard of Fintech Holdings, let alone seen them here.”

According to public registration records, Fintech Holdings was incorporated on July 25, 2019. Its founding chairman, Md. Nasir Uddin, transferred his shares and left the company in October 2023. He was replaced by Selina Akhtar, representing a construction firm, Adon Construction and Dredging Ltd.

Reached by phone, Ms. Akhtar confirmed her role as chair but was unable to explain what business Fintech Holdings actually conducted. When asked about the company's managing director, SM Kamal, she told Bangla Outlook, “I haven’t met him. He sits somewhere else, and I sit somewhere else.”

Another listed director, Sarwar Rahman Dipu, seemed equally in the dark. “I don’t know which company I’m a director of,” he said in a brief phone call, before disconnecting.

Murky documents about ownership

Among Nagad’s top domestic shareholders is Blue Water Holdings Ltd., which controls 6 percent of the company. On paper, the firm is located on Kamal Ataturk Avenue in the upscale neighborhood of Gulshan-2.

But the address raises eyebrows–Kamal Ataturk Avenue lies in Banani, not Gulshan-2, a designation that doesn’t exist on any Dhaka street map. The company is chaired by Nahim Razzak, a former lawmaker of Awami League.

Another shareholder, TASIA Holdings Ltd., owns 2.4 percent of Nagad. The company is chaired by Tanvir Ahmed Mishuk, who personally holds 47,500 shares. Fellow director Rokshana Kashem Tumpa owns 2,500. Like Fintech Holdings, TASIA lists its head office in Delta Dalia Tower, the same building where Nagad is headquartered.

A visit to the office on a recent Tuesday told a story of decline. On the second floor, two employees sat in an otherwise empty office with dozens of vacant chairs. The building's doorman, when asked about TASIA Holdings, offered a telling observation: “The office was very busy during the Awami League government. Now it operates only nominally.”

That downturn in activity coincides with the political fall of the Awami League last year. Mishuk, the company’s chairman, is widely known to be a close associate of Sajeeb Wazed Joy, the son of ousted Prime Minister Sheikh Hasina and the architect of the government’s "Digital Bangladesh" vision–a connection that may have opened key institutional doors for Nagad.

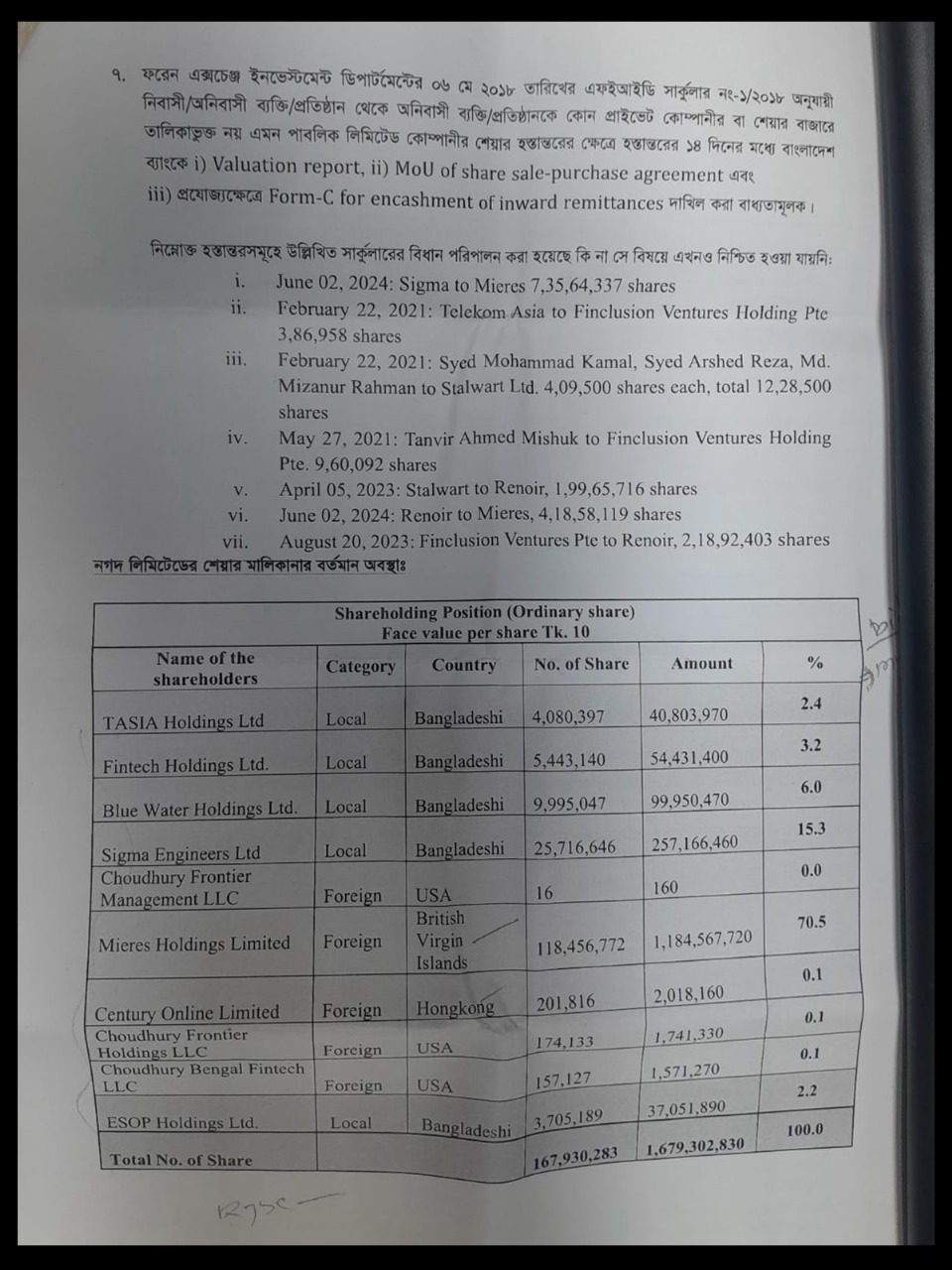

Nagad’s equity structure is divided among ten entities–five domestic and five foreign. The company currently has 167.9 million ordinary shares, amounting to 1.6793 billion taka at a face value of 10 taka per share.

Among Nagad's domestic shareholders, Sigma Engineers Ltd. holds the largest share at 15.3%, followed by Blue Water Holdings Ltd. with 6%, Fintech Holdings Ltd. at 3.2%, TASIA Holdings Ltd. at 2.4%, and ESOP Holdings Ltd. with 2.2%, bringing the total ownership of these local firms to just under 30%.

The remaining 70.9% of Nagad is held by foreign entities, a significant proportion for a financial services company, with Mieres Holdings Ltd., based in the British Virgin Islands, being the most substantial shareholder, possessing 70.5% of the equity.

The remaining four international shareholders–Chowdhury Frontier Management LLC and Chowdhury Frontier Holdings Ltd. (both U.S.-based), Century Online Ltd. (Hong Kong), and Chowdhury Bangla Fintech LLC (U.S.)--each hold less than 1 percent.

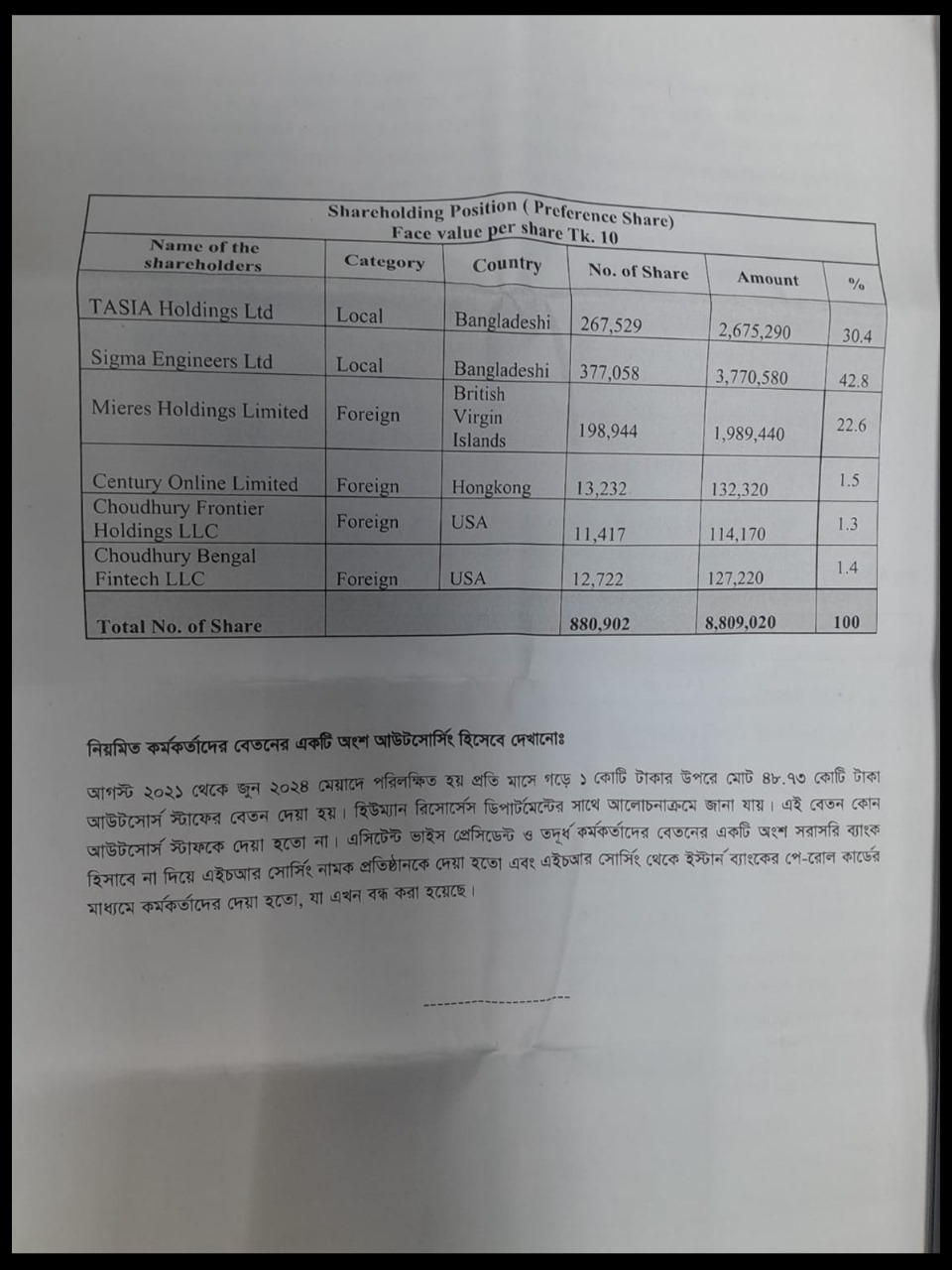

In addition to its ordinary shares, Nagad has issued preference shares totaling 8.8 million taka. These carry seniority over common stockholders in dividends and liquidation events. The primary holders of preference shares are Sigma Engineers (42.8%), TASIA Holdings (30.4%), and Mieres Holdings (22.6%), with the remaining three firms collectively owning just 4.2%.

While complex ownership webs are not unusual in high-growth tech companies, it was the rapid and opaque capital movements that raised red flags.

Between July 2021 and September 2022, Candle Stone Investments Partner Ltd., a local asset management firm, deposited 500 crore taka–roughly $45 million–into Nagad’s accounts at Social Islami Bank and One Bank.

In exchange, commercial papers amounting to 450 crore taka were issued at a 6 percent interest rate. The remaining 50 crore taka was used to issue ordinary shares valued at over 62 crore taka.

But what happened next caught the attention of investigators.

A tangle of domestic and offshore

capital

On October 27, 2022, less than a month after receiving shares tied to a 500 crore taka investment by Candle Stone Investments Partner Ltd., those same shares–valued at over 62 crore taka–were quietly transferred to Sigma Engineers.

The swift sequence of events, combined with the circuitous conversion of debt into equity, raised red flags among regulators, who now suspect the transaction was designed to mask ultimate ownership through a laundering-like mechanism.

The October transaction was far from isolated. According to internal reports reviewed by Bangla Outlook, Sigma Engineers was already accumulating control of Nagad’s equity well before the Candle Stone deal.

On June 4, 2020, the company acquired 377,000 preference shares, previously held by three individuals–Syed Mohammad Kamal, Syed Arshad Reza, and Mohammad Mizanur Rahman–each of whom transferred 125,000 shares.

On March 10, 2022, bonus shares were issued based on share premiums, granting Sigma Engineers ownership of over 5.75 million ordinary shares. That same year, on October 27, the firm received an additional 6.21 million shares from Candle Stone.

The pace only accelerated in 2023.

On January 16, 2023, Nagad Limited entered into a loan agreement with Sigma Engineers for 25 crore taka. Just six days later, that figure was revised upward to a staggering 400 crore taka–at 0% interest. Then, on January 24, the two companies signed a separate deal: Sigma would receive 20% ownership in Nagad in exchange for a 500 crore taka equity injection.

Yet what followed defied the terms on paper. Between January and December 2023, Sigma deposited only 236.15 crore taka, well short of the promised 500 crore. Nevertheless, on February 11, 2024, Nagad issued 33.76 million ordinary shares to Sigma Engineers–effectively handing over 20% of the company for less than half the agreed amount.

The administrator's investigation described the entire chain of deals–from the initial loan agreement to the share issuance and subsequent transfers–as “suspicious in timing, valuation, and intent.”

The next moves only deepened the mystery.

Offshoring the ownership

On April 5, 2023, Sigma transferred 10.9 million ordinary shares to Fintomo, another little-known Bangladeshi company. Then, on June 2, 2024, a massive share transfer took place: Sigma handed over 73.5 million shares to Mieres Holdings Ltd., a company registered in the British Virgin Islands, widely known as a secrecy jurisdiction for offshore wealth.

By June 30, 2024, RJSC records showed Mieres Holdings had emerged as the controlling shareholder of Nagad, holding 70% of its total equity.

Mieres had first entered the picture back on July 29, 2020, when it purchased 199,000 preference shares for $3 million (approximately 25.35 crore taka). Then, on March 10, 2022, it received an additional 3.03 million ordinary shares as bonus shares.

The final leap in control came in June 2024, when, in addition to Sigma’s shares, Mieres also received 41.8 million shares from Renoir Consulting Pty. Ltd., another foreign shareholder.

To the team appointed by Bangladesh Bank to oversee Nagad’s restructuring, the pattern was unmistakable. “The issuance of multiple share agreements within a span of eight days, the undervalued sale of equity, and the rapid transfers to offshore and low-profile entities suggest a coordinated effort to reassign ownership while bypassing scrutiny,” the administrator’s report noted.

On September 28, 2022, Nagad issued ordinary shares worth 500 crore taka to the Dhaka-based firm Candle Stone Investments Partner Ltd.. But within just one month, on October 27, every share was quietly transferred to another domestic entity: Sigma Engineers Ltd. That same firm would soon find itself at the heart of a dizzying round of equity dealings.

Between January 16 and January 24, 2023, two separate agreements were signed between Sigma and Nagad—each promising 20 percent ownership in exchange for 500 crore taka. But Sigma ultimately secured the full 20 percent stake after investing just 236 crore taka, not the agreed amount. Investigators have since questioned why no mechanisms were in place to prevent or flag this shortfall in capital.

Then, the shares began to move again–this time, overseas.

On April 5, 2023, 10.97 million ordinary shares were transferred from Sigma to Fintomo, another Bangladeshi company.

Then, on June 2, 2024, 73.56 million shares–a major holding–were handed over to Mieres Holdings Ltd., a company registered in the British Virgin Islands, a well-known tax haven. Investigators say this marked the moment control of Nagad passed, without public scrutiny, to a foreign offshore entity.

But the share transfers didn’t end there.

Further documents reviewed by Bangla Outlook reveal that additional shares, originally held by Canadian firm Stalwart Ltd. and Singapore-based Finclusion Ventures PTE, were also transferred to Mieres.

Today, Mieres controls over 70 percent of Nagad’s total equity, according to filings from the Registrar of Joint Stock Companies and Firms (RJSC).

A digital mirage

What’s more concerning, officials say, is how these foreign investments evaded central bank oversight altogether.

Under the Guidelines for Foreign Exchange Transactions (GFET)-2018, any transfer of shares to or from foreign individuals or entities in unlisted Bangladeshi companies must be reported to the Foreign Exchange Investment Department of Bangladesh Bank.

The rules require the submission of a valuation report, a memorandum of understanding (MOU) for the transaction, and a Form-C for documenting the foreign remittance, all within 14 days of the share transfer.

Yet, in the case of Nagad, none of these filings were made.

“There is no record of any inward remittance or transfer involving the foreign companies that now appear on Nagad’s books,” a senior Bangladesh Bank official told Bangla Outlook, speaking on condition of anonymity. “We have no record of how these entities acquired their shares, or through which banks the money entered the country–if it did at all.”

This regulatory void has raised alarms inside Bangladesh’s central bank and has now triggered a full-scale probe.

The gravity of the matter was publicly acknowledged by Muhammad Badiuzzaman Didar, the Bangladesh Bank director and administrator now overseeing Nagad.

“I was appointed after the change in government. What we have found so far is deeply troubling,” Didar said in an interview with Bangla Outlook. “There is already a case pending for the unauthorized creation of 645 crore taka in e-money. Now, we are also investigating potential share manipulation and offshore laundering.”

He confirmed that a forensic audit is underway, led by the administrator team appointed by the central bank in the wake of the Awami League’s electoral defeat. Early findings suggest Nagad’s financial troubles run deeper than originally assumed.

According to internal documents, Nagad was supposed to operate under a 2017 agreement between the Directorate of Posts and Third Wave Technologies Ltd., which allowed the issuance of e-money only against actual cash deposited in banks. But the administrator’s team found that 645 crore taka in digital money had been created without corresponding deposits, a blatant violation of regulatory limits.

Further investigation revealed a second, more troubling pattern: 1,711 crore taka had been withdrawn through 41 unauthorized distributor accounts, all tied to the disbursement of government social allowances.

“These distributor accounts were never vetted,” the administrator noted in a report. “They were opened without approval, and much of the withdrawn money remains unaccounted for.”

Insiders say Nagad’s selection as the government’s distribution channel for welfare payments was no coincidence. Several shareholders and board members had direct political ties to the ruling Awami League, raising concerns that Nagad’s rapid rise may have been less about innovation and more about proximity to power.

“The company became a preferred partner of the government not just because of its technology–but because of who owned it,” a former senior finance official told Bangla Outlook.

—-