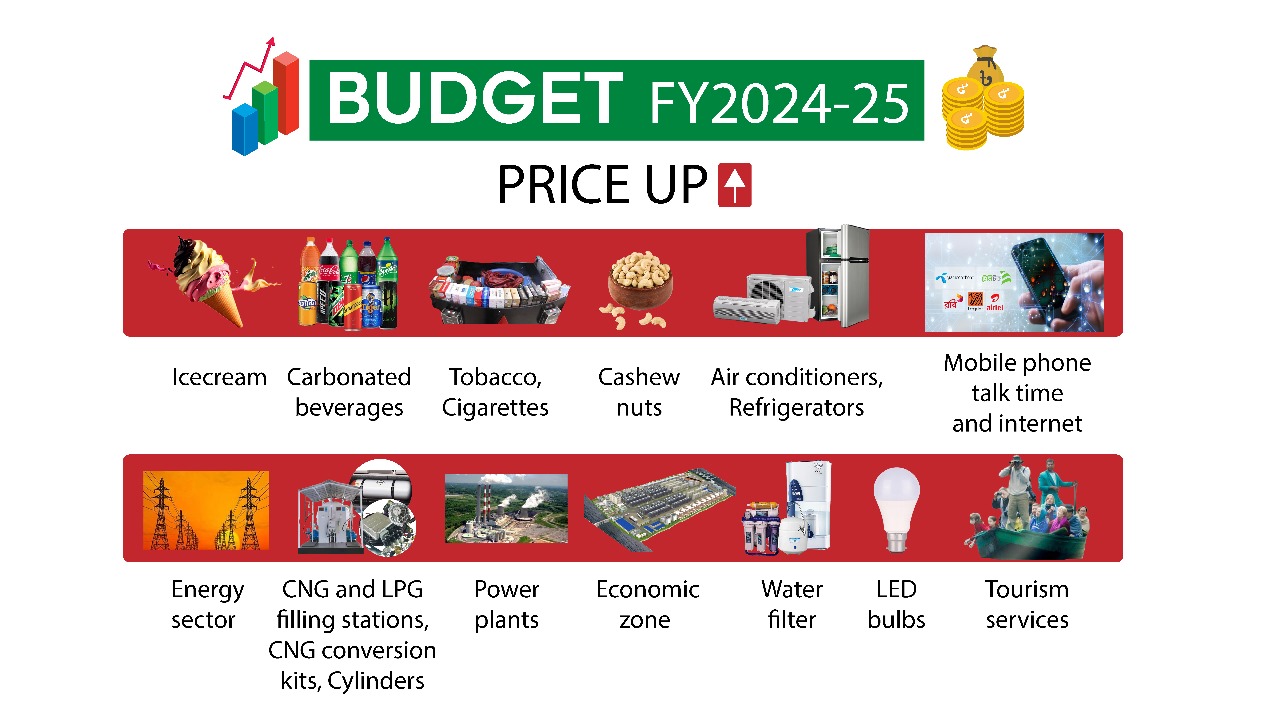

Consumers may face higher prices for phone and internet services, as well as certain types of fuel, due to proposed increases in supplementary duties.

The changes could affect SMS and call rates, internet costs, and prices for furnace oil, lubricants, mineral lubricants, and base oil.

Prices are also set to rise across all types of cigarettes due to a significant 60-65.5% increase in supplementary duty.

Also, the cost of switching to CNG fuel may become more expensive as import duties on these items are proposed to increase from 3% to 5%.

The government's proposed budget also includes import duty increases on components used in air conditioners and refrigerators, as well as household water filters and energy-saving bulb materials. These tax hikes could lead to price increases for consumers.

Meanwhile, the budget proposes import duty reductions on 30 essential commodities, including rice, edible oil, and sugar.

It also eliminates VAT on aircraft engines and propellers, reduces supplementary duty on powdered milk, and lowers duty on imported chocolate, potentially leading to price reductions for consumers.

The budget also proposes VAT removal on laptop imports, import duty reductions on engine parts for motorcycles under 250cc, and tax exemptions on dengue test kits and certain medical equipment.

Additionally, import duties are lowered on polypropylene yarn for carpet production.