Nvidia's rise to the top: The AI chipmaker taking over the world

In a stunning turn of events, Nvidia, the darling of Wall Street's artificial intelligence boom, has ascended to the throne as the world's most valuable company, dethroning the longtime tech giant, Microsoft.

This meteoric rise was cemented on Tuesday when Nvidia's market capitalization reached a staggering $3.34 trillion, narrowly edging past Microsoft's $3.32 trillion valuation. Apple, once the undisputed leader, now finds itself in third place with a market cap of $3.27 trillion.

Nvidia's shares soared 3.5% higher on Tuesday, fueled by the insatiable demand for its AI-powering chips, while Microsoft and Apple experienced slight declines, a Reuters report says.

This milestone marks a significant achievement for Nvidia, as it joins an exclusive club of US companies to have surpassed the $3 trillion market cap threshold.

The company's dominance in the AI landscape, particularly in the realm of generative AI—the technology behind groundbreaking tools like ChatGPT—has propelled its stock to unprecedented heights.

Nvidia's unmatched expertise in producing processors that drive these advanced AI systems has solidified its position as an industry leader and a favorite among investors.

A new era for the world

As the AI revolution continues to reshape the global economy, Nvidia's reign at the top signifies a new era in the tech world, where AI-driven innovation is not just a buzzword, but the driving force behind the world's most valuable companies.

Nvidia's extraordinary ascent has been nothing short of meteoric, with its stock surging over the past year and a half, a series of reports by Reuters show. This remarkable performance can be attributed to the company's unrivaled prowess in crafting processors that fuel the artificial intelligence revolution, especially in the realm of generative AI.

As the undisputed leader of the "Magnificent Seven" tech stocks that have propelled much of the stock market's recent gains, Nvidia has become a Wall Street sensation.

Its stock, boasting an impressive 174%

year-to-date increase, reigned as the S&P 500 index's top performer in

2023, says a report of Bloomberg.

The company's CEO, Jensen Huang, has orchestrated this remarkable journey, culminating in Nvidia's dethroning of Microsoft in the ongoing battle for Wall Street supremacy.

The competition among tech giants for the coveted top spot has been fierce, with Apple briefly claiming the title on June 13th following its annual Worldwide Developers Conference, where it unveiled generative AI features for the iPhone.

However, Apple's reign proved short-lived, as its market cap slipped below Microsoft's just a day later.

How did Nvidia reach the top?

Nvidia's origin story is as unique as its meteoric rise. Founded in 1993, the company's inception famously took place over a meal at Denny's. From those humble beginnings, Nvidia embarked on a journey to design a revolutionary kind of programmable computer chip.

For decades, the US chip industry had been dominated by giants like Intel and Advanced Micro Devices (AMD), who specialized in central processing units (CPUs). These chips, the backbone of basic computing and software processes, were the industry standard.

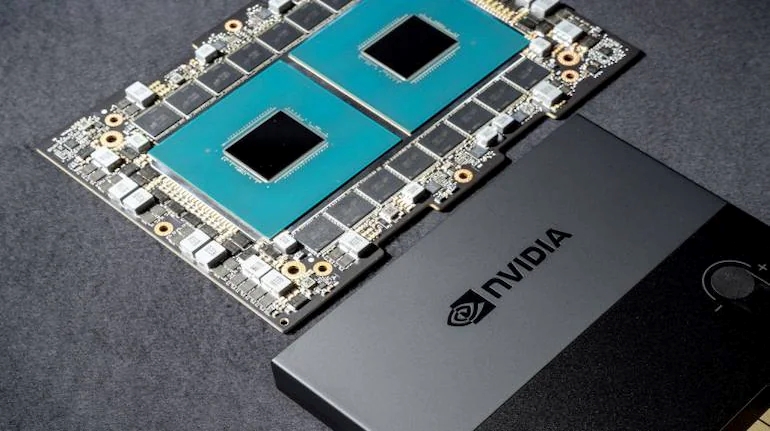

Nvidia, however, charted a different course, focusing on graphics processing units (GPUs). Initially associated with video and computer games due to their superior image rendering capabilities, GPUs eventually revealed their hidden potential.

This potential lies in their ability to perform calculations concurrently, a feat not easily achieved by traditional CPUs.

This parallel processing prowess made GPUs not only more energy efficient but also ideally suited to handle the complex computational demands of emerging technologies like artificial intelligence.

This pivotal insight, recognizing the untapped power of GPUs, would prove to be the catalyst for Nvidia's remarkable transformation from a graphics chip specialist to the driving force behind the AI revolution and, ultimately, the world's most valuable company.

As the potential of GPUs became evident, other major chip makers entered the arena, producing their own versions to compete.

However, Nvidia's early entry into the GPU market had given it a significant head start. The company had established itself as the go-to source for GPU needs, thanks to a combination of factors.

Nvidia not only offered powerful chips but also a comprehensive suite of accompanying software that developers favored for its ease of use and versatility.

Furthermore, its well-developed supply chain enabled the company to manufacture GPUs in larger quantities, more quickly, and with greater reliability than its rivals.

This competitive edge allowed Nvidia to expand its reach beyond gaming and into other industries.

Automotive companies, for example, began incorporating Nvidia chips into driver-assistance software that relies on processing image data from sensors. This technology is now a standard feature in all Tesla vehicles.

Despite these successes, Intel remained the larger company in terms of market capitalization until 2020, highlighting the formidable competition Nvidia faced in the chip industry.

However, the tides were about to turn as the AI revolution began to gain momentum, propelling Nvidia to new heights and eventually surpassing its long-standing rival.

Pandemic surge turns into AI revolution

The pandemic acted as an unexpected catalyst for Nvidia's growth. The shift to remote work and the subsequent surge in demand for cloud-based computing infrastructure, coupled with increased interest in video games during lockdowns, propelled Nvidia's revenues to new heights.

Then, a seismic shift occurred as Silicon Valley, spearheaded by OpenAI, recognized the transformative potential of artificial intelligence across industries.

Nvidia, with its comprehensive ecosystem encompassing software and efficient sourcing of materials, positioned itself as the indispensable partner for companies seeking the immense computing power required to harness AI's capabilities.

Nvidia CEO Huang, acknowledged in a CNBC interview last year that the company's success is a blend of serendipity and strategic foresight.

This combination of factors has propelled Nvidia from its modest beginnings to the forefront of the AI-driven technological landscape, solidifying its position as a global powerhouse.

Huang attributes the company's success to a combination of foresight and serendipity. While acknowledging the element of luck, he emphasizes that the company's core vision of accelerated computing laid the groundwork for their dominance in the AI landscape.

Today, Nvidia's influence is undeniable, with virtually every major tech company—including Amazon, Google, Meta, Microsoft, and Oracle—utilizing its chips.

Bloomberg News has dubbed Nvidia's chips the "workhorse for training AI models," and PNC Financial Services Group analyst Amanda Agati described Nvidia's position as a "quasi-monopoly" in the AI chip market.

Raj Joshi, Senior Vice President at Moody's, recognizes Nvidia as the "dominant" infrastructure player behind the current AI boom. While other chip designers strive to catch up, Nvidia's three decades of GPU specialization give it a significant advantage.

Joshi stated in an interview with NBC News, "This emerging field [AI] is better supported by GPUs," adding, "Nvidia is providing the foundation for it in most cases."

–